The shares that contributed the most during March were Exclusive Networks, United States Lime & Minerals, and Catena. Those with the weakest performance were SOITEC, Napco Securities, and YouGov. Once again, small caps have seen good momentum during the month, with upticks of 20–30% among the best performers. As we have written previously, small caps hold underlying strength for release once positive market sentiment for the sector returns.

This month, we highlight Exclusive Networks. The largest shareholder in the company has announced it might buy out the company and delist it, since it finds the company undervalued. Generally, we believe European small caps appear far cheaper at present than their US small cap peers, for example.

Coeli Global has changed name to Brock Milton Capital

We would like to highlight the change in name of our fund management firm to Brock Milton Capital. The name comes from founders Andreas Brock and Henrik Milton, and signals dedicated commitment, recognition, and sustainability. Our global small cap fund is also changing name as part of the move, becoming BMC Global Small Cap Select as of May 3. As a customer, you do not need to do anything to remain a unitholder; simply keep your fund units in your deposit account and, after May 6, the fund will show up under its new name.

Key market events and trends (what has influenced performance most?)

We believe inflation has settled at a lower level, with the five most recent data points (readings) in the US in the 3.1–3.3% interval. US policy rates are steady at 5.5%, where they have been since August 2023. Among other factors prompting the Fed's caution in reducing interest rates is that the US job market has proven particularly strong, with low unemployment. In one of his latest speeches, Jerome Powell emphasized the importance of inflation settling at a lower level before the Fed will begin cutting policy rates. This is because the Fed wants to avoid unpleasant surprises for the equity and bond markets should it be forced to change footing and again make hikes after a few rate cuts.

Portfolio changes

During March, we sold Finland's Mandatum and France's SOITEC. Mandatum was a Special Situations that we bought in 2023, and we have now sold it after a decent upswing in its share price. The reason we sold semiconductor manufacturer SOITEC is its guidance for a challenging 2024. Instead, we have chosen to invest in other semiconductor companies.

The fund's positioning—our market expectations

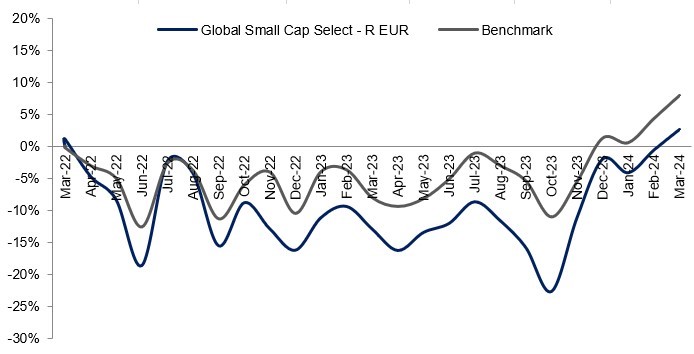

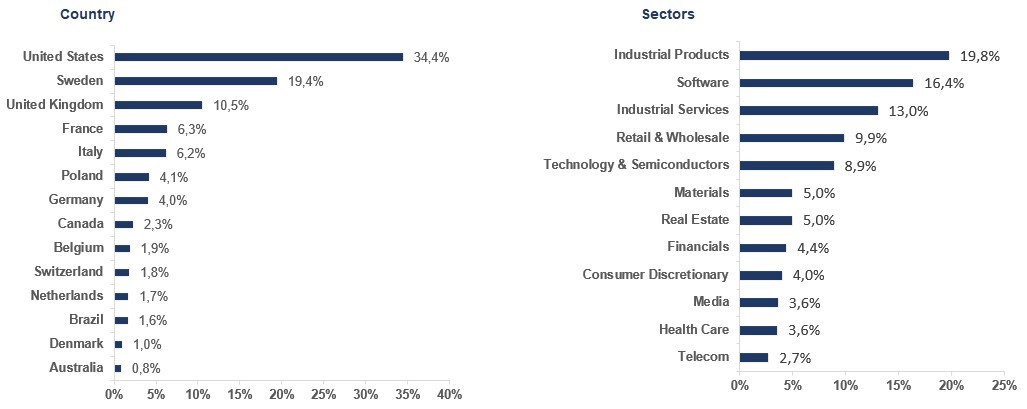

The solid improvement during the month suggests the fund is keeping up well in a rising market. We believe we have a superb balance between different regions and sectors, and in particular, we see great value in European small caps, which appear to be valued below their American cousins.

We thank you for entrusting your capital to us and hope you share our enthusiasm for the new names for our fund management firm and funds.