Please note:

Past performance is not a guarantee of future returns. The value of shares in the fund may go up or down, and an investor may not get back the amount originally invested

Blog & Media

Monthly Newsletter | 4 dec 2025

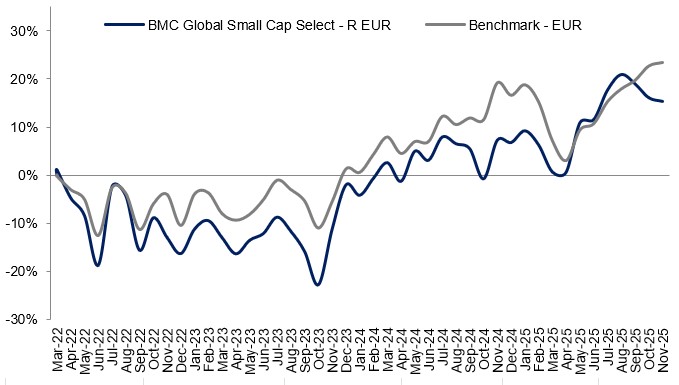

The performance of BMC Global Small Cap Select during November was 0,65% which was 1,26 percentage points short of the fund's benchmark index*.

The strongest contributors to the fund's returns during the month were Nagarro, Porr Group, and First Advantage, while the weakest were United Parks & Resorts, GXO Logistics, and Climb Global Solutions.

Once again, the month was characterized by quarterly reports. The best contributor in November, Nagarro, delivered an incredibly strong report across all points and was rewarded with a share price increase of more than 50% in subsequent weeks. We wrote about this company in our August newsletter:

An entrepreneurially driven Indian IT consultants with a customer base comprising leading global companies across a broad swathe of sectors. Following a spin-off, the company is now listed in Germany. The company has a history of high organic growth, double-digit operating margins, and robust cash flows, but it has traded down to single-digit profit multiples owing to accounting deficiencies, a weaker consulting market, and strong currency headwinds that overshadow the solid improvements in its results during the year.

Currency headwinds lessened considerably during the third quarter, allowing Nagarro to build a solid underlying profit development (the margin was up 300 points) that was reflected in the reported numbers. Organic growth of 9% was also far better than the market overall, as many IT consultants were again plagued by negative organic performance. Moreover, the strong cash flow prompted the company to restart its share buyback program.

On the same theme, the month's worst contributor, United Parks & Resorts, was also impacted by its report. Unfortunately, its report came in worse than expected, with revenues shrinking by 3% y/y and operating costs rising, which led to EBITDA narrowing by 16% and net profits down by 25%. The report highlighted shortcomings in a business that we had previously considered to be stable and predictable.

We have posted articles about our analyst trips on our website (https://www.bmcapital.se/en/blogg). Readers can also find shorter comments about our trips and company meetings on our LinkedIn page.

Key market events and trends

The global stock markets proved volatile during November, with a poor start to the month and a robust recovery towards the end. We saw the markets breathe more freely once Nvidia reported good figures, with investors subsequently allowing themselves to hit the "buy button" once more. Another key event in November was the US government reopening after its period of shutdown. Interestingly, the market reaction was minimal, despite parts of the US having been at a standstill. The effect of the shutdown will likely be seen in the labor market statistics in December. A third factor that impacted the market was the speculation regarding whether the Fed will lower interest rates or not in December. At the moment, Donald Trump is doing his best to unseat Fed chair Jerome Powell and replace him with someone more willing to cut interest rates and do what Trump says. We will in all likelihood return to this topic in our next monthly newsletter.

Portfolio changes

Given the market turbulence, we have been more active than usual, making more changes this month than we typically do over a longer period. In total, we added five new holdings to the fund during November. We have, after several months of analysis, including a couple of analyst trips, started building positions in Japanese companies.

Alior Bank: A Polish bank focusing on mortgages, consumer loans, and corporate lending that delivers high profitability despite its history of problematic non-performing loans. New bank taxation reforms and the interest rate reduction cycle have put pressure on the Polish banking sector. Alior Bank trades at around 1x equity and 9x profits for 2026, which we consider a low point given a temporary tax rate of 30% (due to come down to 26% in 2027 and 23% in 2028) and a central bank interest rate being lowered by approximately 100 basis points.

GMO Payment Gateway: The leading payments company in Japan, processing around 50% of the country's total card transactions. Despite a sizable increase in card transactions in Japan, which has helped GMO to grow by more than 20% a year on average over the past two decades, cash remains the country's most common payment method. Regulatory initiatives intended to increase card penetration from just over 40% today to close to 80% in five to six years will provide GMO with further tailwind and the company targets tripling its profits through 2031.

Group 1 Automotive: A US vehicle dealers that focuses on premium cars, for which business is far more stable than the company's valuation would indicate. Around 70% of gross profits are from stable recurring aftermarket revenues, while the remaining 30% stems from the more cyclical sales of new and used cars. Thanks to good capital allocation, the company has increased its earnings per share by more than 20% over a ten-year period. This is through acquiring complementary businesses at attractive multiples and recurring share buybacks at low average valuations.

Kandenko: A Japanese installation company that concentrates on new construction and renovation of offices, public sector buildings, data centers, and energy projects. Structural changes in the industry have resulted partly from a renewed contract structure that allows the installer to pass on cost increases to the end-customer, and partly through changes to the regulations governing overtime. This has created a favorable supply situation in which reputable players can be selective in which projects they choose to bid on, leading to substantially better margins and profitability.

Takasago Thermal Engineering: Another Japanese installation company, this one focusing on data centers and semiconductor plants. It benefits from the same structural industry changes that aid Kandenko, with an environment in which reputable players can be selective in which projects they choose to bid on. Moreover, Takasago is also helped by its considerable exposure to semiconductors and data centers, areas that are currently undergoing an enormous investment boost in Japan.

During November we also sold three holdings. One was REV Group after a takeover bid from Terex Group. Rev Group has been a successful Special Situations holding that has doubled in price since we bought into the company in June 2024. Unfortunately, the proposed transaction structure is far from optimal. In principle, the takeover bid is a 1-for-1 conversion of REV shares into Terex shares, which means that REV shares now trade in tandem with Terex shares. The market did not take the news well, with the share prices of both falling dramatically. We had intended to own REV Group for longer, as we had seen upside in its ongoing streamlining and margin expansion, but as its investment basis had changed completely with the takeover proposal, we chose to sell it. We sold Thryv Holdings and United Parks & Resorts after our initial investment hypotheses in them proved incorrect. In Thryv's case, our decision to sell was led predominantly by a deterioration in the customer retention rate in its SaaS business. And, as stated above, we had misjudged United Parks & Resorts's ability to adjust prices. This meant it wasn't able to offset cost inflation, in turn leading to less stable earnings than expected, with a negative effect on its ability to finance share buybacks.

The fund's positioning

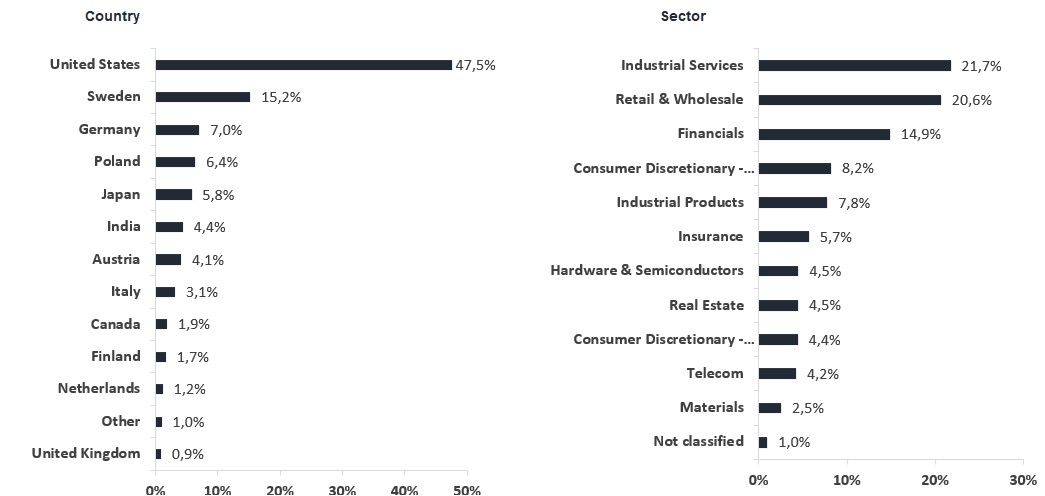

The fund now comprises 38 companies exposed to a range of sectors and geographies, with each company chosen on its own merits. Over time, we believe a concentrated but diversified actively managed small cap fund focusing on stock picking has the potential to deliver great returns to unitholders.

*MSCI ACWI Small Cap NTR $ in EUR

Monthly Newsletter | 17 feb 2026

Monthly Newsletter | 17 feb 2026

Monthly Newsletter | 15 feb 2026

This website is using cookiesfor statistics and user experience

This website uses cookies to improve your user experience, to provide a basis for improvement and further development of the website and to be able to direct more relevant offers to you.

Feel free to read ours privacy policy. If you agree to our use, choose Accept all. If you want to change your choice afterwards, you will find that option at the bottom of the page.