The strongest contributors to the fund's performance in December were FlatexDegiro, Rusta, and Palomar, while the weakest contributors were United Natural Foods, Blue Bird, and Lindex.

FlatexDegiro was again the best monthly contributor to the fund's total return. At the beginning of the month, the company posted a solid KPI report for November, and if this trend continued during December, it is likely to reach, or even surpass, its raised forecast range for full-year 2025. More positive news came at the end of the month, when Germany took another step towards implementing a reform aiming to stimulate private pension saving. The reform, which is intended for implementation from January 1, 2027, was not included in the three-year plan that FlatexDegiro announced just under a year ago. Instead, the company contented itself by noting that such a reform, and how it will be implemented, can offer sizable market potential for the company.

United Natural Foods, which was the month's worst contributor to the fund's total return, issued a quarterly report and arranged a capital markets day during December. We consider the report to have been strong, with high profit growth thanks to margin improvements, while communication regarding the capital markets day was positive, with a new three-year plan that exceeded consensus expectations. The market disagreed, however, and the share price saw double-digit falls on both the report and the capital markets day. Interestingly, the company is expected to generate free cash flows equivalent to around 50% of its market value in the coming three years. Around half of this will be used to amortize debt in order to reach the company's target of a net debt/equity ratio below 2.0x within three years, and the other half could be distributed to shareholders. At the current valuation level, we would recommend share buybacks.

Key market events and trends

Among the events with the greatest impact on stock market performance during the month was Broadcom's quarterly report, which saw the share price dropping by double digits on reporting day, taking other semiconductor companies with it. As semiconductor and software companies are in related industries, their stock prices influence each other when they report their earnings. These companies are affected by the same news flow, and AI news is currently the key driver of their share prices.

The Fed undertook its third interest rate cut for the year, something that had a generally positive effect in the stock market. Another positive factor was that inflation figures for the US economy came in favorably, prompting a robust positive rebound in the market. Lower inflation is positive since it allows for more Fed rate cuts, among other things, during 2026.

Portfolio changes

During December, we added one new holdings and sold off two smaller positions. Our new holding is Sdiptech.

Sdiptech: A Swedish serial acquirer that owns a portfolio of European companies with solid niche positions within infrastructure. Following a period of aggressive acquisition growth, during which it spent far more than its underlying cash flows, propelling its net debt ratio upwards, the new management team has shifted its focus to an overall target of improving profitability (ROCE >15%) and reducing the debut/equity ratio, with balanced growth of 15%. Given its current valuation of around 13x underlying cash flows for 2025E, we see great opportunities for a revaluation of the company if management can deliver reasonably in line with the target.

Games Workshop and Volution Group, which we sold off during December, are both well-run companies, but we judge them to be trading largely at full valuation after strong share price movements. We thus see better return potential elsewhere.

The fund's positioning

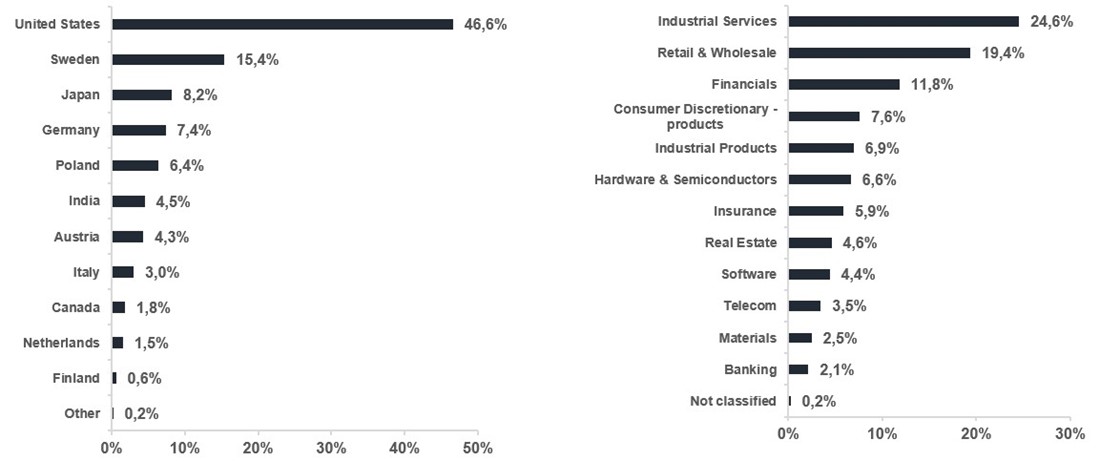

The fund currently comprises 37 companies exposed to a range of sectors and geographies, each company chosen on its own merits. Over time, we believe a concentrated but diversified, actively managed small cap fund focusing on stock picking has the potential to deliver great returns to unitholders.

* MSCI ACWI Small Cap NTR $ in EUR