The stocks that offered the best contributions during the month were Siegfried Holding, First Advantage, and Autopartner. Those with the weakest performance in August were Axcelis Technologies, Aixtron, and Legacy Housing.

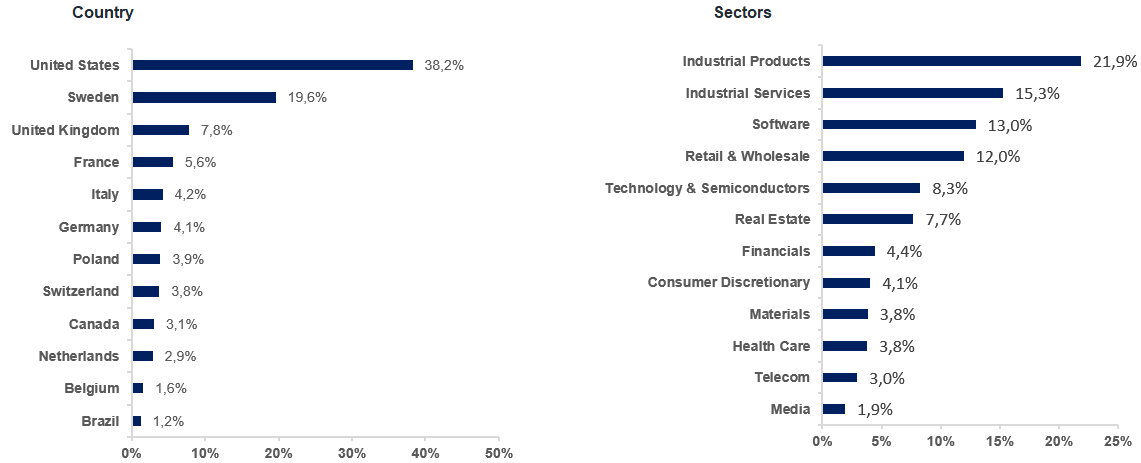

First Advantage issued a stable report, delivering better q/q, which was in line with what the company had communicated. It reiterated its full-year guidance, pleasing the stock market. One of our Polish holdings, Autopartner, also had a solid month. Although Autopartner holds a large market share in the Polish service market, the company is now also growing strongly elsewhere in Europe, using its domestic market as the basis for this expansion. Smaller semiconductor companies (such as Axcelis and Aixtron) have had a challenging first half of the year, but we now expect a broader recovery in the semiconductor cycle (not just large-scale investments in AI). We have seen signs from semiconductor companies that imply a turnaround is around the corner.

Key market events and trends (what has influenced performance most?)

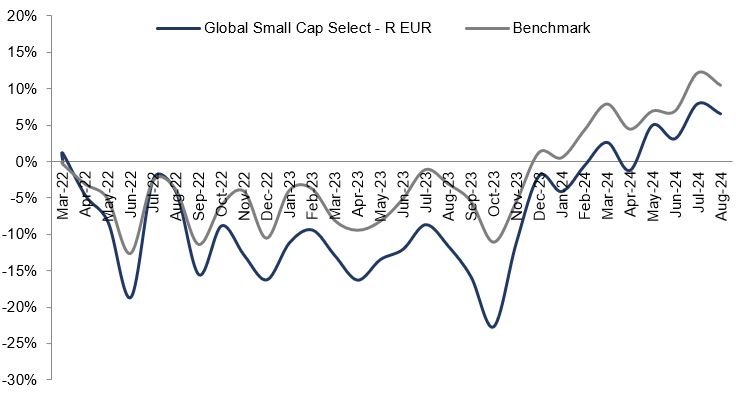

A general semiconductor frenzy has gripped the market in recent months and debates rage about how whether and how far investments in artificial intelligence (AI) will be sufficiently profitable to match the levels of capital being invested. At the time of writing, one of our fund managers and an analyst are traveling in California to meet NVIDIA, Tesla, Cadence, Broadcom, Salesforce, and others to read the signs they give about investments in AI, among other things. Our narrowing of the fund's semiconductor exposure this summer seems to have been the right call as semiconductor companies have had a challenging time so far this year. We want to emphasize, however, that semiconductors are a rapidly growing industry, and so even though we have reduced our exposure, we will see them pick up again in the foreseeable future. During the summer, we also saw the Japanese stock market plummet. We do not hold any stocks there and the market movements have had more to do with "carry trades" stuck in a deadlock than any fundamental issues with the Japanese economy. The beauty of this is that the subsequent volatility has made it even more likely that interest rate cuts in emerging markets countries will now come sooner and stronger than was the case before this correction.

The positive aspect of the decline in the stock markets this month has been that company valuations have come down more, meaning that our small cap fund is now even cheaper than it was the previous month. We see clear signs that the 10-year US treasury bond yield is trending down, suggesting that the fixed income market anticipates a Fed rate cut during September.

Portfolio changes

We made no changes to our global small cap fund during August.

The fund's positioning—our market expectations

The latter half of the summer has been quite messy on the stock markets, but we believe this turbulence has accelerated the US's first rate cuts. In our view, interest rate cuts are likely on an ongoing basis during the fall, starting from September. Many of the stocks that performed poorly during the summer, such as semiconductors and engineering, will benefit from lower rates in the future. Our small cap fund sees an attractive relationship between the companies' expected profit growth and valuations (PEG ratio). In our newsletters during 2023 and 2024, we have written much about the significance of small caps benefiting from a lower interest rate environment. Now most likely awaits the Fed's first rate cut, which we believe can prove a great catalyst for the stock markets, and particularly for smaller companies.