September was a decent month for equities, with stock markets rising around the world and our global fund returns increasing by almost one percent. We also saw the long-awaited interest rate cut in the US, which gave the markets an additional boost.

Looking more closely at the specific positive contributors to the fund's performance in September, United Natural Foods, Alphabet, and TSMC were the winners. Our relatively new holding of United Natural Foods was the month's best performer thanks to a great report. After the company raised its EBITDA guidance on reporting day, the share price rose by 18%.

The worst contributors to the fund's performance were S&P Global, Millrose Properties, and Sea. Despite S&P Global's good report, surpassing analyst expectations, the market chose to trade the stock down during September. We believe the share price dropped because one of the company's most important business areas, bond ratings, saw a weaker development during the past quarter.

During September, our investment management team took trips to New York and San Francisco. In California, we had exciting meetings with Nvidia, Broadcom, Salesforce, Arista Network, and more. While in New York, we met several great companies, including JPMorgan, Datadog, and IBM. We have published blog posts about these trips on our website.

Key market events and trends

At last, we saw the long-awaited interest rate cut in the US, with the Fed lowering the key interest rate by 0.25 percentage points in mid-September. Led by Donald Trump, the White House has long exerted incredible pressure on the Fed to make its first rate cut. We anticipate at least two further rate cuts this year, whether or not Donald Trump continues to apply the pressure.

Vast AI investments lift the US economy, and the global semiconductor industry is also growing through investments. All countries want to jump on board the AI megatrend, and in the past month, we have seen sizable share price increases for hardware manufacturers in the semiconductor industry.

Since the start of the year, we have seen relatively significant declines in the US dollar of 10–15%, depending on which currency we look at. For an American, the S&P 500 index is up this year though (+13% in USD) and closed the month of September at an all-time high. During the summer, the S&P 500 strengthened and has more than made up for its considerable drop from April. We also believe the worst of the squall regarding tariffs has begun to ease and looking at the upturn in the US indices, the market seems to agree.

Portfolio changes

We made four changes to the Special Situations part of our fund during September. We sold the US's Rev Group and France's Veolia, instead buying Canada's Wheaton Precious Metals and Sea Ltd from Singapore.

We had bought into Rev Group in June 2024, seeing the share price rise more than 100% in SEK since then. And this is despite the turbulent US presidential election during the past year, followed by the introduction of monumental tariffs on imports to the US. We sold Veolia and instead allocated the money for our new Special Situations companies that offer greater potential. The rapidly growing Sea has operations in e-commerce, gaming, and payments. Wheaton Precious Metals primarily invests in goldmines, as well as silver mines. Wheaton operates its business as a "streaming company," which means that it doesn't operate the mines itself but instead takes an ownership share in the gold and silver mines. Its share price is one of the gold companies to best track the price performance of physical gold, but even if the gold price has stagnated, Wheaton's revenues are expected to rise by around 40% thanks to increased extraction from mines.

The fund's positioning

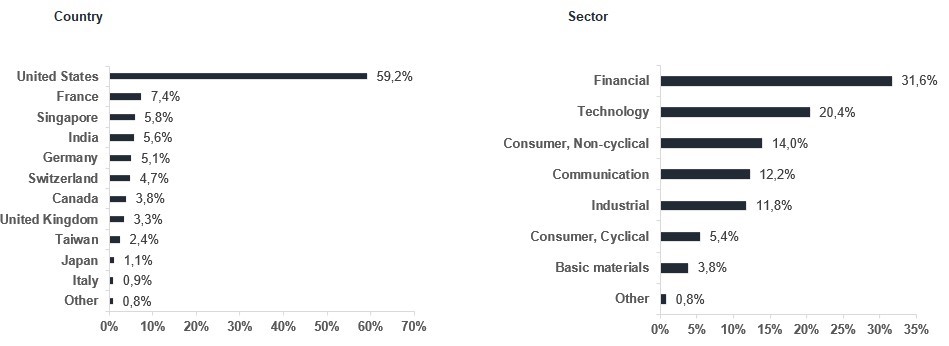

We believe we hold a robust portfolio in our global fund as we head into the third quarter reporting season, with a selection of high-quality Champions and several exciting Special Situations. The estimated and aggregated profit growth for our portfolio next year is currently around 20%. We also expect the coming rate cuts in the US will continue to spur the equity markets upward as a whole. We have increased our focus on markets other than the US, and these should bear fruit in the form of new investments.

We thank you for your continued faith in us in investing your capital.

* MSCI All Country World NTR $ in EUR

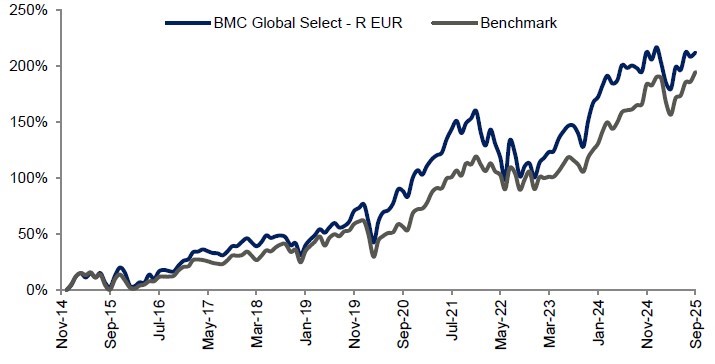

| 1 Mth | YTD | Five years | Since Inception |

| BMC Global Select Fund - R EUR | 1,21% | 2,05% | 65,48% | 212,04% |

| Benchmark (EUR) | 3,14% | 4,25% | 88,15% | 194,78%

|