The strongest contributors to the fund's performance in September were United Natural Foods, Tutor Perini, and Climb Global Solutions, while the weakest performers were IDT, Rusta, and Truecaller. We wrote about the fund's best contributor in September, United Natural Foods, in our July newsletter:

One of the largest food distributors in the US, which has seen profitability issues spurred by a bad acquisition. A newly recruited management undertook to optimize the distribution network and end unprofitable contracts, prompting a successful turnaround with definitive profitability improvements and solid reductions in the debt ratio. Following temporary setbacks owing to a cyberattack in June, which left the share plummeting more than 30%, we bought into the company. We believe the cyberattack was a dip in the curve and that the company's underlying improvements will be increasingly visible in the coming years.

The cyberattack very much proved a blip in the curve, and at the time of its annual report for fiscal year 2024/25, the company offered expectations for the next fiscal year that far surpassed analyst consensus. The company also raised its targets for growth and cash flow generation in the medium term. It is interesting to note that analyst consensus was clearly too low, despite the company indirectly having already communicated approximate profit forecasts to the market on several occasions by moving forward its debt ratio target. Thus, it has been possible to calculate approximately what the company expects for profits for 2025/26 long before it offered a concrete forecast.

IDT, the largest negative contributor to September's performance, also reported its fiscal-year report for 2024/25. Results for the current year were solid, but the forecast for the coming year initially appeared weak, and the share price traded down substantially on the news. Breaking down the forecasts shows that the market appears to have overreacted, however. IDT aims to build niche businesses in communication and payments and subsequently divest or spin them off. At present, the company comprises three growth companies and a cash cow, with the company's entire value effectively placed in the two largest growth businesses—NRS (payment terminals) and Boss Money (cross-border transfers)—growing profitably by 20–25% a year. This is expected to continue throughout the forecast period. However, the disappointment was regarding the cash cow, which is consistently shrinking and for which we believe any forecast deviation should have had an extremely minor impact on the total company value.

Key market events and trends

September was a relatively placid month on the macro front, with minimal political maneuvering or geopolitical events that influenced the market. We have, however, seen the first of the long-awaited interest rate cuts by the Fed and the ECB, and we anticipate at least two further rate cuts by the Fed this year, whether or not Donald Trump continues to apply the pressure on the central bank. Since the start of the year, we have seen relatively significant declines in the US dollar of 10–15%, depending on which currency we look at. For an American, the S&P 500 index is up this year though (+13% in USD) and closed the month of September at an all-time high. We also believe the worst of the squall regarding tariffs has begun to ease and looking at the upturn in the US indices, the market seems to agree.

Gold has continued to rise in value against the fiat currencies, which can be seen as a vote of no confidence in monetary and fiscal policies in many of the world's largest economies. At the same time, stock markets continue to rise to new record levels, and as active managers, we continue seeking well-positioned companies with attractive risk-adjusted return profiles.

Portfolio changes

We added no new holdings during September, although we sold four smaller positions. Lime, Redox, and Siegfried are all well-run companies, but as the market prices in far higher growth for them than what they currently can deliver. We thus see better returns potential elsewhere. We dipped our toes into Swedencare during the spring, expecting accelerated organic growth and margin expansion that didn't materialize. Moreover, instead of prioritizing the repaying of debt, the company has continued to make expensive acquisitions.

The fund's positioning

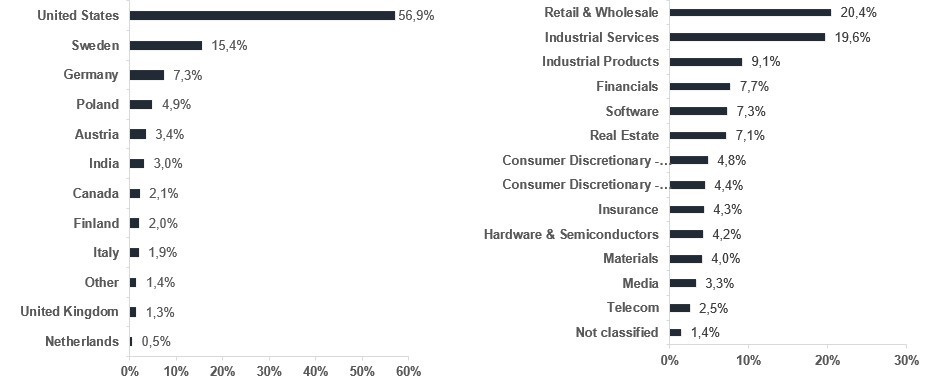

At present, the fund comprises 38 companies exposed to a range of sectors and geographies carefully selected based on the companies' own merits. Over time, we expect that a concentrated but also diversified actively managed small cap fund that focuses on stockpicking holds the potential to deliver compelling returns to its unitholders.

*MSCI ACWI small Cap NTR $ in EUR