The equity markets saw a certain nervous energy in November that came from semiconductor companies. In the days ahead of Nvidia's report, the stock market balanced on a knife-edge in anticipation of the company's results. The market could breathe a sigh of relief when the report came and, as is often the case with Nvidia, the company beat market expectations for both revenues and profits.

Looking more closely, the companies that offered the best positive contributions to the fund's returns for the month were Alphabet, Wheaton Precious Metals, and HCA Healthcare. The weakest contributors to returns were 3i Group, Nvidia, och Sea. Alphabet's status as one of the best contributors during the month stemmed from its leadership position in software (AI programs like Gemini) and hardware (AI chips such as TPUs) for artificial intelligence. We have always taken a positive long-term view on Alphabet's abilities within AI development and in creating commercially viable AI products. The main negative contribution to the fund's returns was from Singapore's Sea, which reported during the month. Revenue growth of more than 38% and net profit growth of 144% was not enough to please the markets, which had even higher expectations for these two figures. Incidentally, Sea was one of the companies we met during our Singapore–Japan trip in November. Sea is an exciting growth company that specializes, among other things, in e-commerce in South East Asia and is an expert at earning money in low per capita GDP countries, such as Indonesia and Brazil.

During the month, we took two analyst trips (Asia and the US) to visit existing holdings and interesting companies that we could consider investing our funds in. In Singapore and Japan, we met SGX Group (Singapore exchange), Sea, Kandenko, and Kyoto Financial Group, all of which are BMC Global Select holdings. In the US, we met companies that we hold in our global small cap fund. During December, members of the analyst team will travel to Arizona to attend a tech conference.

Key market events and trends

The global stock markets proved volatile during November, with a poor start to the month and a robust recovery towards the end. We saw the markets breathe more freely once Nvidia reported good figures, with investors subsequently allowing themselves to hit the "buy button" once more. Another key event in November was the US government reopening after its period of shutdown. Interestingly, the market reaction was minimal, despite parts of the US having been at a standstill. The effect of the shutdown will likely be seen in the labor market statistics in December. A third factor that impacted the market was the speculation regarding whether the Fed will lower interest rates or not in December. At the moment, Donald Trump is doing his best to unseat Fed chair Jerome Powell and replace him with someone more willing to cut interest rates and do what Trump says. We will in all likelihood return to this topic in our next monthly newsletter.

Portfolio changes

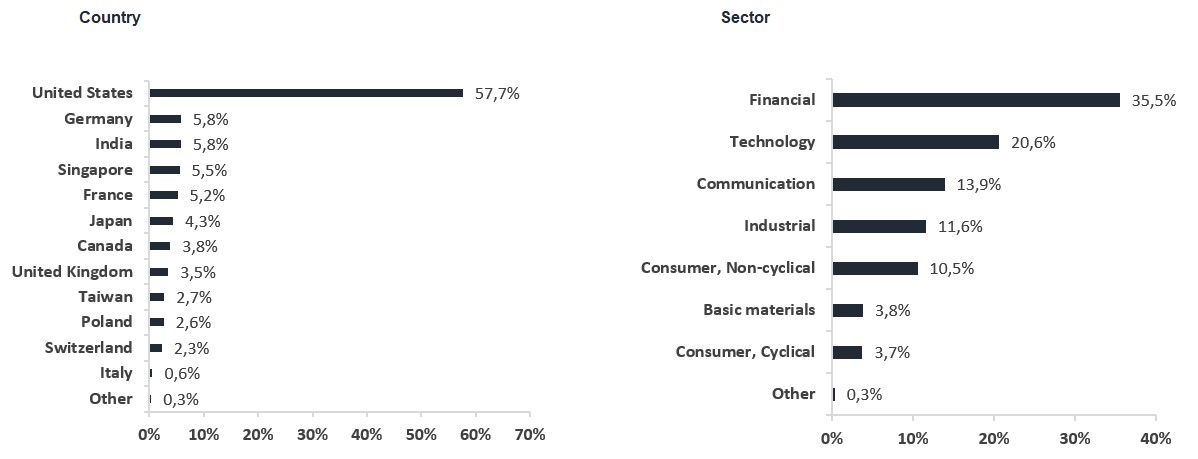

We made a handful of portfolio changes during November, tightening our global fund further. We bought two and sold two Champions. One of our additions was Bharti Airtel, which is one of the two largest telecom operators in India, operating across 18 countries in Asia and Africa. Bharti has demonstrated impressive growth that it maintains by rolling out 5G—and, in the future, 6G—in its markets. Our other new Champion is Bank Pekao, one of Poland's largest banks. We anticipate good upside in the bank based on its low valuation (P/E of 8.7x), decent profit growth, and an exciting structural transaction with a Polish insurance firm we also own. During the month, we sold pharma manufacturer Siegfried and India's ICICI Bank.

The fund's positioning

We have a solid equity portfolio with high forecasted profit growth of +25% for 2025/2026. We also have a relatively high share of Special Situations at 25%, with several interesting names with great returns potential. We have made and will undertake further analyst trips focusing on South East Asia, India, and Poland, which will bear fruit in the form of new investment ideas.

We thank you for your continued faith in us in investing your capital.

*MSCI All Country World NTR $ in EUR

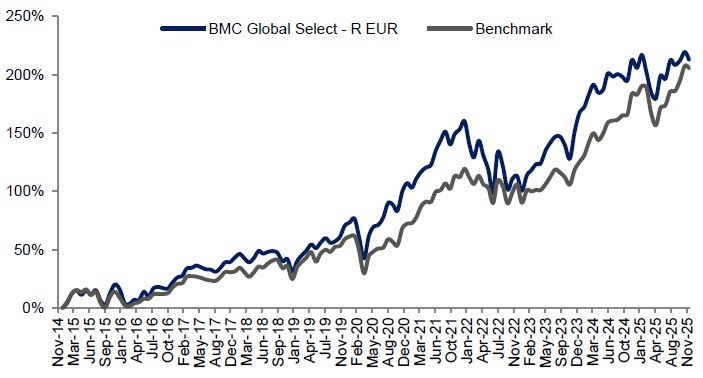

| 1 mth | YTD | Five years | Since Inception |

| BMC Global Select - R EUR | -2,12%

| 2,21%

| 56,29%

| 212,54%

|

| Benchmark - EUR | -0,65%

| 8,03%

| 81,42%

| 205,46%

|