We can conclude that 2025 was a turbulent year of three key events: Donald Trump being sworn in as US president; Liberation Day in April, which kicked off the introduction of US tariffs; and the weakening of the US dollar, which lost a total of 16% against the Swedish krona over the year. The dollar's decline and the weaker performance of some of our holdings were the two most significant factors behind the fund's poor returns in 2025.

December was a relatively stable month for equities, with the Fed making its third rate cut of the year, taking the Fed's key interest rate to 3.75%. This level will help spur the US economy and stock market. Looking closer at specific companies that contributed positively to the fund's performance, Charles Schwab, FlatexDegiro, and Wheaton Precious Metals were the key names. The poorest contributors to returns were Broadcom, HCA Healthcare, and United Natural Foods. Interestingly, Wheaton's share price moves similarly to the price of gold. When the dollar has weakened, the gold price has risen, and so too has Wheaton's share price.

In December, we attended the UBS tech conference in Scottsdale, Arizona. During that week, we had more than 20 meetings with both semiconductor and software companies, and our overall conclusion from these is that interest in further investments in AI tech is high, with considerable demand for various AI services.

Key market events and trends

Among the events with the greatest impact on stock market performance during the month was Broadcom's quarterly report, which saw the share price dropping by double digits on reporting day, taking other semiconductor companies with it. As semiconductor and software companies are in related industries, their stock prices influence each other when they report their earnings. These companies are affected by the same news flow, and AI news is currently the key driver of their share prices.

The Fed undertook its third interest rate cut for the year, something that had a generally positive effect in the stock market. Another positive factor was that inflation figures for the US economy came in favorably, prompting a robust positive rebound in the market. Lower inflation is positive since it allows for more Fed rate cuts, among other things, during 2026.

Portfolio changes

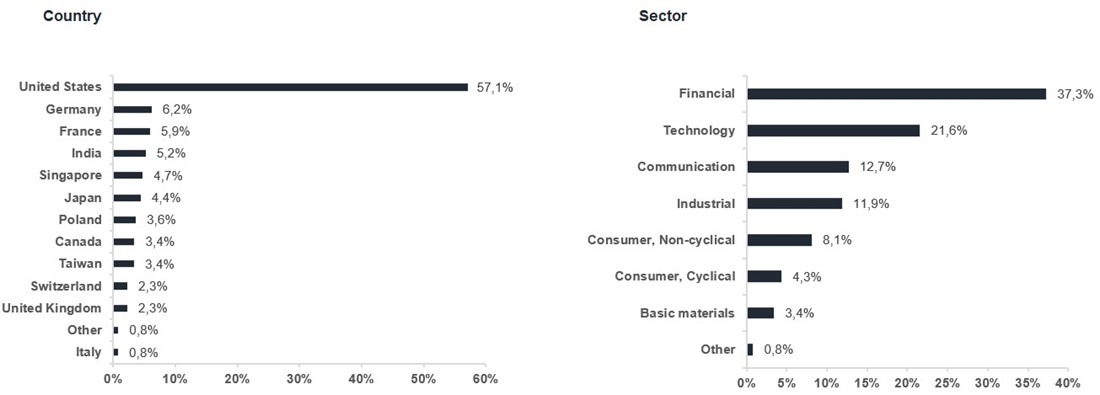

To sharpen our global fund further, we made additional changes during December. We bought two new companies and sold two holdings. We added Polish bank PKO Bank as a Champion. We like to invest in Poland, as the country offers good growth and a lower-valued equity market with a range of quality companies. Twenty years ago, Poland was considered a poor nation, but the country's prosperity is now increasing and its economy blooming, readying Poland for the next step: increased lending. Thanks to excellent growth and rising real estate prices, the banks will lend money to a greater extent to private individuals and companies, generating attractive interest income for the banks. We also note that Polish banks have higher net interest income (giving greater profitability) than Swedish banks, for example. The other new company we bought into was Lennox International, a Special Situations play. It is a leader in HVAC (heating, ventilation, and air conditioning) and cooling technology. Lennox currently trades at a valuation that corresponds to a two-year low, which, combined with the positive triggers we see, makes it a particularly appealing Special Situations option. During the month, we took profit in two other Special Situations: Verisure and Everus Construction. We had bought into security company Verisure at its IPO in the fall, while we bought Everus around a year ago.

The fund's positioning

We still hold a strong active portfolio with high forecasted profit growth of around 25% and consider the valuation of the fund to be particularly attractive. We head into 2026 with a high share of Special Situations at around 25%, featuring many fascinating companies with great return prospects. We look forward to an exciting year with excellent opportunities to earn money from the companies in our global fund.

We thank you for your faith in us in investing your capital.

* MSCI AC World NTR USD in EUR

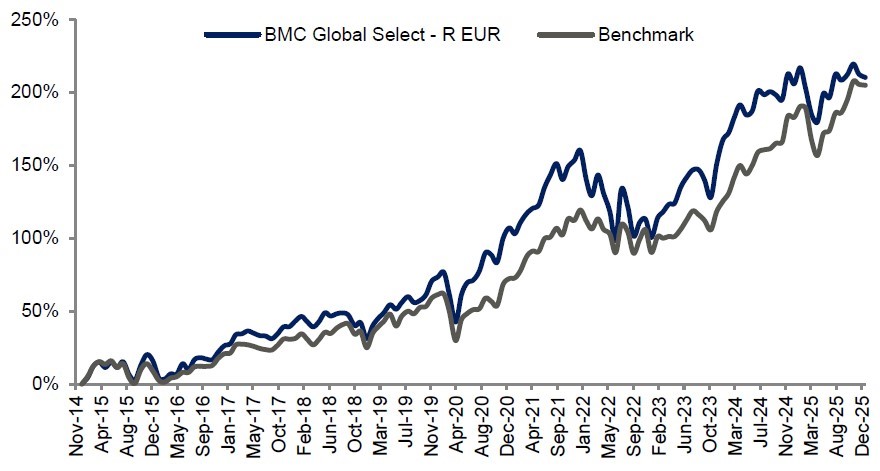

| 1 mth | YTD | 5 Years | Since inception |

BMC Global Select Fund - R EUR

| -0,76%

| 1,44%

| 49,84%

| 210,18%

|

| Benchmark - EUR | -0,22%

| 7,79%

| 76,91%

| 204,79%

|