Henrik Milton

CEO and Portfolio Manager with a focus on tech and software, Brock Milton Capital AB

Please note:

Past performance is not a guarantee of future returns. The value of shares in the fund may go up or down, and an investor may not get back the amount originally invested

Blog & Media

Blog | 17 okt 2025

In October 2025, we traveled to Maranello to join the capital markets day, marking the fourth time we’ve met the company since 2023. Ferrari showed, among other things, its new car plant with EV production, making this in hindsight one of the best capital markets days I have ever attended.

Those who traveled to Italy had hoped to get a glimpse of Ferrari’s new electric car, which has the working name of Elletrica. This wish was “almost” granted as we got to see a third of the car—more on this later. During the two days, Ferrari announced its 2026–2030 guidance, explaining to the equity market how it expects turnover and profits to develop through 2030.

The new electric car

The evening before the capital market day kicked off, Ferrari showed the drivetrain and suspension of its new electric car, Elletrica. Ferrari says this EV provides a delightful drive experience and can go from zero to 100 kph in under 2.5 seconds. Its top speed is unusually high for an electric car at 310 kph. The presentation stated its range is 530 km, which is a highly acceptable driving distance for an EV. What makes Ferrari interesting in comparison with regular car manufacturers is the tech knowledge transfer from F1 into its other car production, and its EV is also spiced up with thrilling F1 tech. The company is taking sustainable development seriously by launching an electric car manufactured from 75% recycled aluminum.

The EV’s launch will be managed in three stages that will, I believe, look like this:

1. Electric motor, drivetrain, and battery pack (shown on 9 October).

2. The car’s interior, which is likely around year-end.

3. The complete car, most likely in the first quarter of 2026.

The reason Ferrari didn’t show the entire car on this occasion was that the company will maintain interest ahead of the big launch.

Car plant visit

After the presentation of the electric motor, drive train, and battery pack, it was time for the factory visit. Unfortunately, as this part is confidential, we were unable to take photos. Ferrari’s aim has always been to manufacture as many vehicle components as possible, allowing it full control over their function, performance, quality, product development, etc. With its own production, the company essentially has control over the entire supply chain to ensure no delays. Two exceptions to this are that it buys in fuel cells from Korea’s SK and that the brakes are purchased from Italy’s Brembo. Even the battery packs are made by Ferrari in Maranello.

We were allowed to see the electric motor, power transmission, and wheel axle—engineering at the highest level. Ferrari is exceptionally proud of its proprietary wheel suspension, which provides maximum driver comfort, along with racing characteristics when desired.

Another reason the company manufactures nearly all parts itself is that this also gives it total control over spare parts supply for older cars. Ferrari says that “every car model is a piece of art” that can live forever. Since its start, Ferrari has manufactured around 330,000 cars and—wait for this impressive figure—of all these, more than 90% still exist today. Any readers who own or drive a Ferrari, you can feel confident that you’ll always be able to get a spare part for your beautiful car.

When the factory tour was over, we were all invited for dinner in the plant itself. It was an incredible experience to eat dinner right in the midst of the assembly line for the Ferrari Purosangue.

Caption: Final assembly of a Purosangue in dynamic Ferrari red.

Caption: Final assembly of a Purosangue in dynamic Ferrari red.

When Ferrari hosts a capital markets day, the company creates a stellar event and ensures the key personnel are at hand. I had the opportunity to chat with Piero Ferrari, son of founder Enzo Ferrari. I was also able to talk to F1 team manager Frédéric Vasseur and Ferrari CEO Benedetto Vigna.

Caption: With Ferrari CEO Benedetto Vigna and Formula 1 team manager Frédéric Vasseur.

Caption: With Ferrari CEO Benedetto Vigna and Formula 1 team manager Frédéric Vasseur.

Ferrari’s massive fan club

There are millions of Ferrari fans around the world. The company has a vast array of customers, all with a common trait: they have a high income or a large fortune. Ferrari splits its customers into Ferraristi (car enthusiasts) who are those who most often buy the latest car model—a group that totals around 180,000 people. The other group is what Ferrari calls the Tifosi, who number around 400 million. When the F1 Grand Prix is held at Monza, outside Milan, the Tifosi are those who stand and wave Ferrari flags and organize the tifo. One smaller division in the company is called Life Style, and this business designs and sells various Ferrari-branded goods ranging from the expensive fashion clothing to the cheaper caps and t-shirts.

Ferrari reduces greenhouse gas emissions

Thankfully, sustainability is important to Ferrari, and the company has a target to reduce its Scope 1, 2, and 3 emissions. The company’s overarching goal is to reduce its CO2 emissions through 2030. A key point along this journey is a 30% greenhouse gas emission reduction between 2021 and 2024 within Scope 1 and 2. The target is to have reduced emissions by 90% since the start in 2021. In terms of Scope 3, Ferrari has reduced its greenhouse gas emissions by 10% since 2021 (reduction in tonnes of CO2 per car). Its aim is to reduce these by 25% between 2024 and 2030. It intends every one of its cars shall “live forever,” which has an environmental aspect in that it never needs to manufacture a new car to replace an old one. 😊

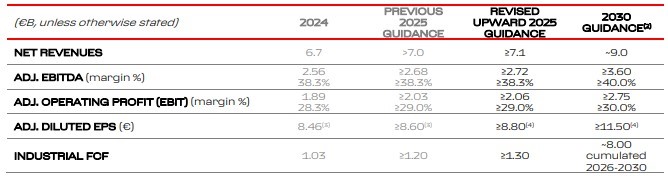

Ferrari’s financial plans through 2030

The company’s guidance is that turnover will expand by 5% each year between 2026 and 2030. Its growth plan expects that turnover will expand by some 34% (in EUR) from 2024 to 2030. On 2030 estimates, the company’s turnover should reach about EUR 9bn. We believe the company has consciously guided low to maintain caution and to be able to surpass its financial target. Setting guidance is challenging at present because of the prevailing situation with the US’s new import duties and weak Chinese luxury consumption.

Ferrari also guides for EBITDA to grow by 44.7% in 2024–2030, which assumes that EBITDA margins increase from 38.3% to 40%. The EBIT margin is expected to hit 30% by 2030, which is a particularly good operating margin for a vehicle manufacturer. At its highest, Porsche’s EBIT margin was 18% in 2023, while that same year, Ferrari’s reached 27.1%.

Ferrari’s intention is for turnover to grow steadily over time. Turnover growth should stem from several product launches, and the company says it will release four new car models between 2026 and 2030. Its sales strategy is to prefer many small model programs rather than a few models that sell in large volumes. Since the start, Ferrari has issued 41 new models, with 14 car launches between 2023 and 2025 alone. CEO Benedetto Vigna constantly emphasizes the company’s motto of scarcity, and that every model should be unique. Enzo Ferrari long ago coined a phrase that survives today: “Ferrari will always deliver one car less than the market demands,” which contributes to this “scarcity.” One way to make cars even more unique is personalization and tailoring the car for each customer. Tailoring a car gives an additional margin boost. During the capital markets day, the CEO explained that the optimal waiting time for a car is 20–24 months. In practice, this means that few cancel an order when they have waited almost two years for their tailor-made pride and joy.

In 2030, Ferrari’s sports car production split will be: 40% from fuel-driven cars, 40% hybrids, and 20% electric cars. I have heard skepticism about the company’s investments into EVs, but we believe Ferrari will reach new customers who don’t want a fuel-driven car, especially those in Asia. The CEO told a story of a potential customer who said: “I’ll only become a Ferrari customer if I can buy an electric car from you.”

Caption: Ferrari is investing in marketing its cars in more colors than the Ferrari red Rosso Corsa and its strategy is to widen the market and reach even more customers.

In the coming years, Ferrari will also launch an entirely new product line that it calls Hypersail. Yes, you read that right: Ferrari will start production of those racing yachts that often compete in offshore sailing races. The rationale behind this product launch is simply that the company believes it can make money by selling yachts.

When it comes to investments, Ferrari has recently completed its EV plant (e-building) and it expects that around 12% of turnover will be invested in new car production through 2030. This is somewhat less than this figure has been historically, which is positive for the share.

To conclude, we like the company’s new capital allocation guidance for 40% going towards capex and 60% to shareholders. The company has also raised its dividend payout ratio to be 40% of profits (previously 35%). The share of capital used for share buybacks will increase by 75% by 2030.

Caption: Ferrari’s financial targets. Source: Ferrari.com

Caption: Ferrari’s financial targets. Source: Ferrari.com

How have we traded Ferrari shares?

Ferrari has been an exceptionally good investment since we bought into the company in 2023. Late this summer, we reduced our weight in Ferrari to around 0.8% in BMC Global Select, and until the capital markets day in October, we have had a low weighting. The equity market’s reception of Ferrari’s guidance has not been positive, and shortly after the company communicated its new target, the share price dropped. We reduced our weighting before the capital markets day because we saw the share trading at a particularly high valuation. The Ferrari share often trades at a higher valuation than its competitors because it is an especially well-run and profitable company. When the valuation reaches appealing levels again, we will increase our weighting. We believe that Ferrari will surprise positively and beat market expectations for both profits and turnover.

We are hopeful regarding the electric car initiative, and we believe Ferrari will continue to grow its turnover and profits steadily while delivering best-in-class margins.

Vrooooom!

Ferrari is a holding in BMC Global Select.

Blog | 20 jan 2026

Blog | 4 nov 2025

Blog | 17 okt 2025

This website is using cookiesfor statistics and user experience

This website uses cookies to improve your user experience, to provide a basis for improvement and further development of the website and to be able to direct more relevant offers to you.

Feel free to read ours privacy policy. If you agree to our use, choose Accept all. If you want to change your choice afterwards, you will find that option at the bottom of the page.