We have been incredibly impressed by the progress made in the country over the last 5 and 10 year periods, with Poland going from “firmly second world” to “firmly first world” and with potential to become one of the wealthiest countries in Europe in the next 5 years. At a high level, over the course of the last 30 years (since the fall of the Berlin wall), Poland has 10x’d [1] their GDP per capita. They are incredibly now at roughly the same level of GDP per capita as France and Italy [2] and rapidly converging on Sweden/Germany.

Examples of the wealth generated in Poland:

- 50%+ of Apartments & Houses in Poland are purchased with CASH (no mortgage) [3].

- The Price-Per-Sq/m of high end apartments being developed in Warsaw is similar to Stockholm [4].

- Most Poles have experienced 10%+ annual wage increases over the last few years.

The opportunity

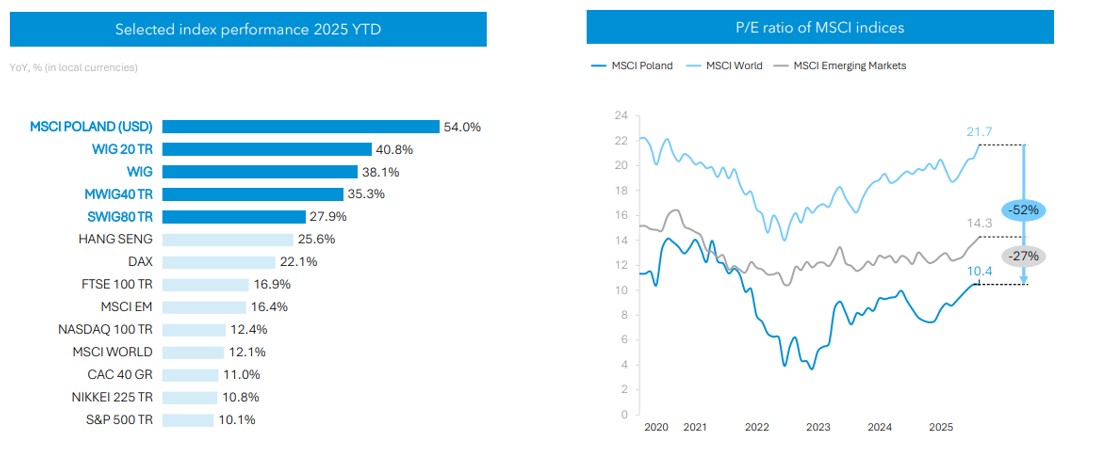

We see an incredibly opportunity for investment in Poland. The Polish economy and stock market are rapidly advancing and still trade at an incredible discount (for a now first world economy). With the introduction of an ISK equivalent[5] in Poland next year, a mandatory savings plan and significant excess household capital. We think the bull market in Poland is just beginning. Interestingly the MSCI Poland index (in USD) is already up 54.6% YTD [6], however still trades at a 52% discount [7] to MSCI World. Investors appear to be waking up to the potential.

What sort of investments are possible in Poland?

The Polish market is still relatively small but rapidly gaining dominance. Currently there are a number of very interesting, well run banks which have amazing Return’s on Equity (often 30-40% vs. typical western banks at ~10-12%).

mBank

We had the pleasure of meeting the Group Treasurer at mBank in Warsaw, who gave us great insight into the banks operations and growth potential. For those who don’t know mBank, mBank is a Polish “online first” bank with an exemplary track record. mBank has successfully grown core Income at nearly 11.5% for the last 15 years [8]. An incredible track record. The company has repeatedly taken market share (currently 8.4%) and aims to triple it’s net income from 2024 to 2030. Incredibly this bank trades around 10x PE, while having Germanys Commerzbank own 69%.

Synektik

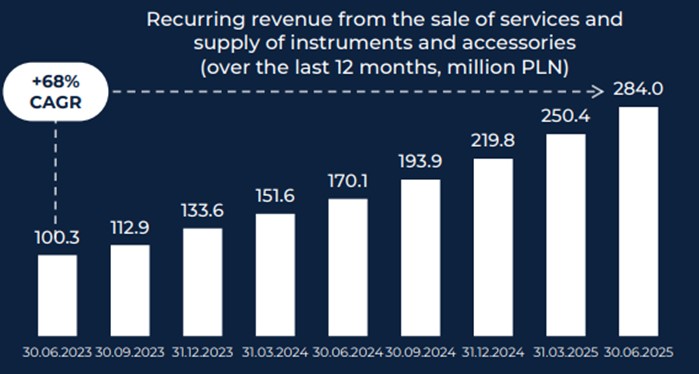

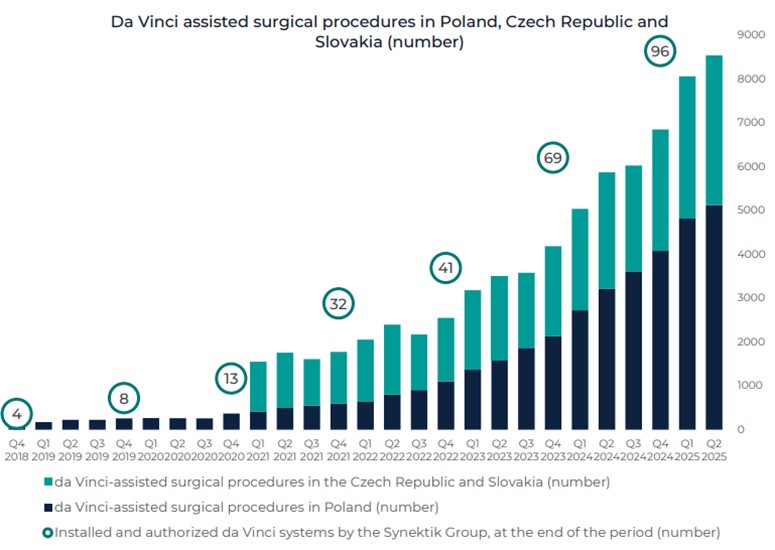

We also had the pleasure of meeting with the IR of Synektik, a medical diagnostic company based in Poland and operating in Poland + Eastern Europe. Amongst other things, Synektik is the exclusive distributor of the American $195bn company Intuitive Surgical (ISRG) with their “Da Vinci” electronic surgery machine. Synektik distributes these machines, and sells spare parts, service and consumables for the machines to hospitals and clinics. As the Polish healthcare system has rapidly scaled, the after market services business of Synektik has grown at an incredibly fast pace, rising at a 68% CAGR from 2023 to 2025.

As the number of machines installed grows, the number of surgeries grows, the consumables and service revenues grow accordingly. In 2018 there were 4 Da Vinci machines in Poland, Czech republic and Slovakia. There’s now over 100 [9] .

Summary

We were lucky to have 15-20 meetings over these two trips and were incredibly impressed with all companies we met. We think the opportunity available in Poland will remain for at least the next 10 years and is likely to continue to accelerate.

[1] https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?end=2024&locations=PL&most_recent_year_desc=false&start=1990&utm_&view=chart

[2] https://www.apolloacademy.com/gdp-per-capita-in-poland-spain-and-italy/

[3] https://nbp.pl/wp-content/uploads/2025/03/Informacja-o-cenach-mieszkan-w-IV-2024.pdf

[4] https://www.domd.pl/pl-pl/warszawa/lista-inwestycji/apartamenty-beethovena/wyniki-wyszukiwania-apartamentow-beethovena?city=warszawa&language=pl-pl&type=mk&viewType=tiles

[5] https://www.gov.pl/web/finanse/od-oszczednosci-do-inwestycji--inwestowanie-bez-podatku

[6] MSCI Poland (USD) as at 28th October, source: CapIQ

[7] https://www.gpw.pl/investor-relations

[8] https://www.mbank.pl/pdf/msp-korporacje/relacje-inwestorskie/strategy-of-mbank-group-for-2026-2030-presentation.pdf

[9] https://synektik.com.pl/wp-content/uploads/2025/09/Synektik_presentation_Q3_2024-FY_EN-final.pdf