Herman Ohlsson

Asisstant Portfolio Manager with a focus on the semiconductor industry, Brock Milton Capital AB

Please note:

Past performance is not a guarantee of future returns. The value of shares in the fund may go up or down, and an investor may not get back the amount originally invested

Blog & Media

Blog | 15 okt 2025

A week in San Francisco always leaves us bursting with energy, stock ideas, and thoughts on where we are headed. The market is at an all-time high, and this was apparent from the meetings we had on the other side of the Atlantic.

Silicon Valley is a unique spot where nothing seems impossible. This almost unshakeable optimism persists, and faith in AI remains robust, even if the tone has turned slightly more modest this year. Several of our meetings made clear how one consequence of AI has been higher customer concentration among companies; how their growth is dependent on a few customers; and how companies with previous mediocre results have suddenly been revived by AI creating ripples. We are undoubtedly moving towards a more concentrated world and equity markets where diversification is being erased and results are driven by a few.

AI brings increased concentration

There are several explanations of why the market could have become so concentrated to so few companies. The first is that the larger US companies referred to as hyperscalers (Microsoft, Google, Amazon, Meta, and Oracle) have built products and services that have proven less cyclical and more structural in nature than those of other companies. This has led to consistent growth and cash generation, even in challenging periods. We don't cancel our Office programs or use Google less when the economy slows. As more and more of these technologies move to profitable cloud storage solutions, growth accelerates and can continue to do so almost independently of which macro climate we find ourselves in.

The second reason is that hand in hand with this consistent growth, these companies have built up enormous cash chests. Since 2022, this has allowed investments in AI for no direct capital cost. They have been able to finance all the data centers and GPUs bought from Nvidia with their own funds, which has also dispersed smaller players and bolstered the already solid competitiveness of the hyperscalers. The companies have self-financed AI without much concern for either the current economic situation or the Fed's rate announcements, which also explains why these investments have been able to continue undisturbed. Alongside the expansion of AI, the companies with existing cash reserves and access to data centers have thus reinforced their strong positions. This has also led to the US today having just over 50% of the world's data centers, an asset that is becoming all the more strategic (Statista).

A handful of tech firms carry the entire index

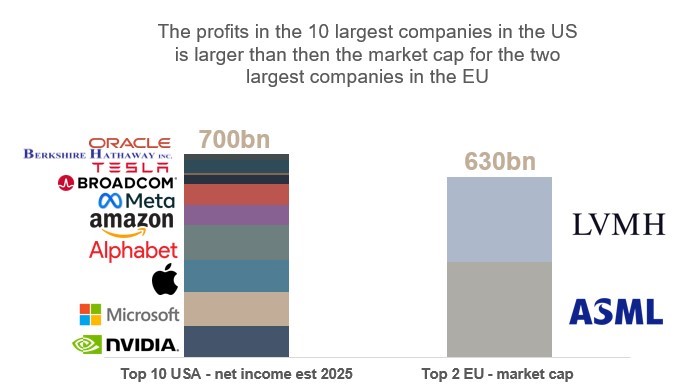

Comparing the total profits of the US's ten largest companies with the corresponding market cap of the two largest companies in Europe helps us to comprehend the magnitude of this. The ten largest in the US (Nvidia, Microsoft, Apple, Google, Amazon, Meta, Broadcom, Tesla, Berkshire, and Oracle) generate more profits than the corresponding market cap of Europe's two largest companies (ASML and LVMH). In other words, the top ten US companies could use their profits to buy Europe's largest two companies.

Chart 1. Profits (USD) for the ten largest US companies versus the market cap (USD) for the two largest companies in Europe. Source: CapIQ.

Chart 1. Profits (USD) for the ten largest US companies versus the market cap (USD) for the two largest companies in Europe. Source: CapIQ.

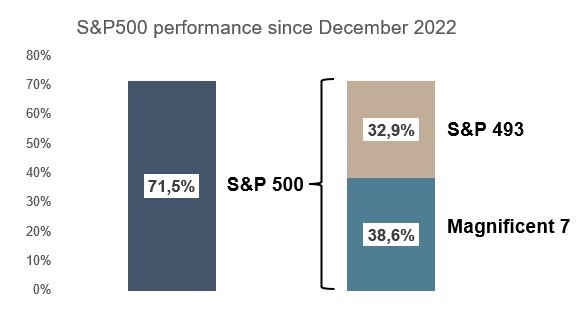

With profits concentrated in only a handful of companies, it is no surprise that a majority of equity market returns can be traced back to that small group of companies called the Magnificent Seven, which today accounts for 35% of the S&P500 index. Never before have so few companies accounted for such a sizable share of returns, and since December 2022, they have generated more than half of the S&P500's upswing of 71.5%. This makes it more difficult to refer to "the market" doing well; instead, it is a few tech giants that are driving such returns.

Chart 2: Returns for the Magnificent Seven and the S&P500's other 493 companies. The Magnificent Seven have accounted for more than half of returns since December 2022. Source: Bloomberg.

Chart 2: Returns for the Magnificent Seven and the S&P500's other 493 companies. The Magnificent Seven have accounted for more than half of returns since December 2022. Source: Bloomberg.

Investments by hyperscalers drive the market

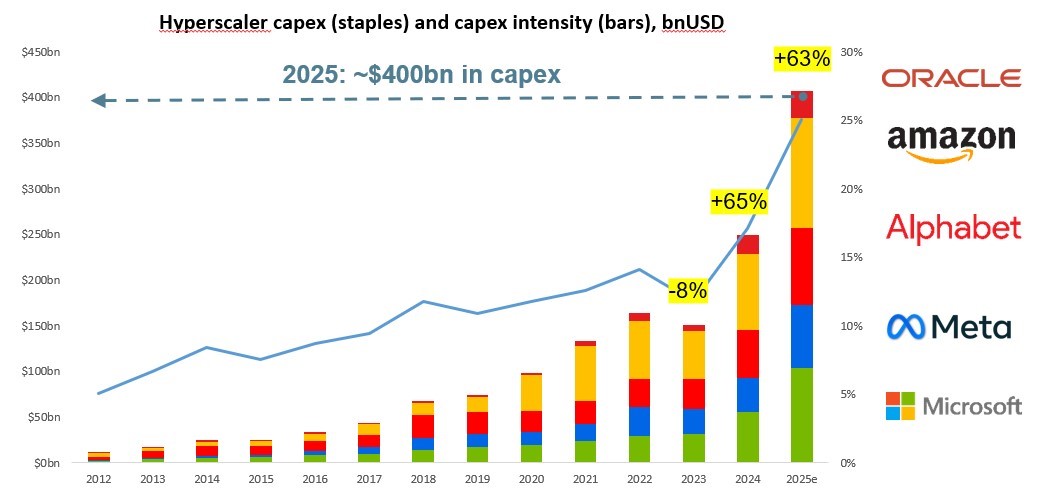

The next natural question is: What is driving all this? The answer is investments (capex) from five hyperscalers (Microsoft, Meta, Alphabet, Amazon, and Oracle), which are expected to spend a combined USD 400bn this year. This is an increase of 63% in 2025, on top of the massive 65% increase we saw in 2024. In other words, investments by these companies have nearly tripled in just two years. A never-before-seen investment pace, and one that has landed in the pockets of just a few companies—with almost half going to Nvidia. The big question is, of course, how sustainable is this pace? And what effect would a slowdown have on the companies it has benefited?

Chart 3: Hyperscaler capex for the top five in the US. Source: CapIQ.

Chart 3: Hyperscaler capex for the top five in the US. Source: CapIQ.

In San Francisco, we met several companies in the AI value chain, focusing on semiconductors, network equipment, cloud storage, software, and energy. It was striking that almost all the companies we met are dependent on investments from the hyperscalers and often generate a majority of their turnover from these companies. Astera Labs, for example, which makes network equipment for data centers, has four large customers that together account for 80% of its turnover. The same is true of Arista Networks, for which Microsoft and Meta account for 20% and 15% of turnover, respectively. Nvidia has all the hyperscalers are customers, together accounting for 50–60% of turnover. We also met neo-cloud player CoreWeave, a cloud company that focuses solely on AI. It has one large customer in the form of Microsoft, representing a massive 62% of its turnover last year.

It is hard to find a more central and decisive figure right now than the investments made by these US hyperscalers. This is what drives turnover for many of the companies that have benefited most from AI so far. The risk now is that the growth in these investments declines, which would mean that growth for many sub-suppliers would also shrink dramatically, since so many companies generate such a large share of their turnover from these USD 400bn investments, both directly and indirectly.

Churchill's quote remains relevant today

The enormous investments in AI have led to incredible growth for a few companies, and have also brought pleasing returns for their investors. This all brings to mind the words of Winston Churchill: "Never... was so much owed by so many to so few." Nvidia has millions of investors, but a majority of the vast turnover growth has come from five customers. We find ourselves in a time when concentration creates enormous returns but with increasing risk. Investing in an index is not what it once was; today, it requires immense faith that the Magnificent Seven will continue to dominate the market in the future, too. How secure really is a market that relies on so few?

Blog | 20 jan 2026

Blog | 4 nov 2025

Blog | 17 okt 2025

This website is using cookiesfor statistics and user experience

This website uses cookies to improve your user experience, to provide a basis for improvement and further development of the website and to be able to direct more relevant offers to you.

Feel free to read ours privacy policy. If you agree to our use, choose Accept all. If you want to change your choice afterwards, you will find that option at the bottom of the page.