Christopher Wright

Portfolio Manager with a focus on the consumer sector, Brock Milton Capital AB

Please note:

Past performance is not a guarantee of future returns. The value of shares in the fund may go up or down, and an investor may not get back the amount originally invested

Blog & Media

Blog | 15 sep 2025

In the end of August, I was lucky enough to make my first trip to Japan to participate in a UBS and Jefferies conference and reverse roadshow of Japanese companies. We had 29 meetings across the course of the week and by the end of the week it was clear that the Japanese market reforms would be seen as very interesting.

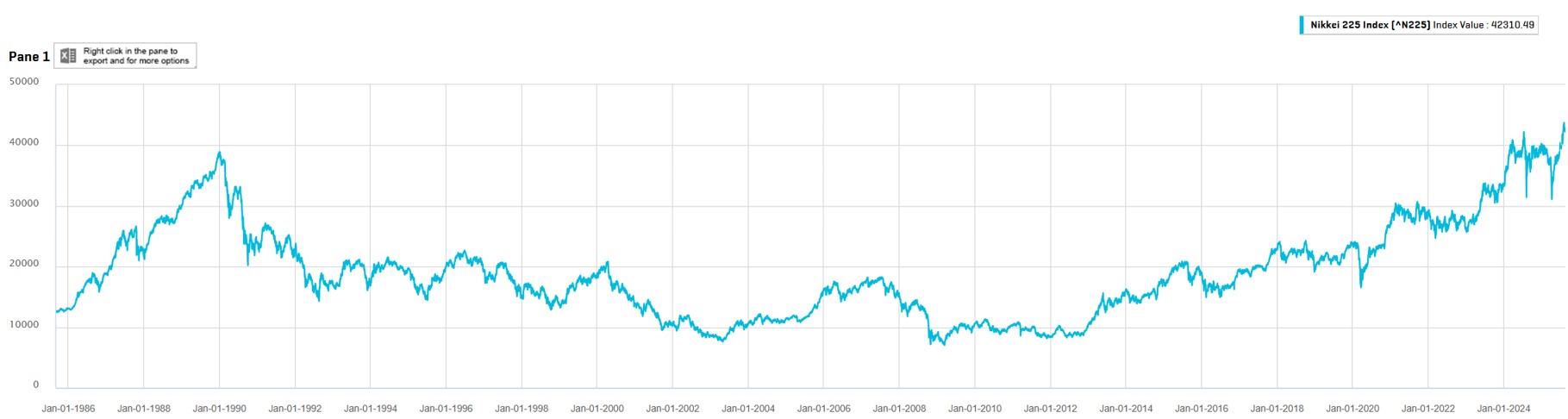

Now historically Japan had been a market of Boom (see 1980’s & tech bubble) and bust (1990, 2000-2014). For those with a long memory, it was widely reported that the land under the Emperors palace (1.15 sq/km) was worth more than all the land in the US state of California. In addition, it took 34 years for the Nikkei 225 Index to regain it’s 1990 high, my entire lifetime.

So for anyone watching Japan after the bubble burst (1990 onwards), it was apparent that Valuation needed to catch up. Indeed Japan’s share of Global Stock market Capitalisation went from 45% (1990) to todays 6%.

Interestingly, 34 years of Valuation catching up is in fact a long time and Corporate Japan got very cheap in the meantime with enormous Balance sheet’s of excess Capital, enormous holdings of Property, Stocks, excess assets and very cheap stock valuations. Even today, it is very common to find Japanese companies trading below Net Current Asset Value (Liquidation value).

Why is this interesting?

So the market blew up and stocks got cheap, well here is the interesting part. From 2023 the Tokyo Stock Exchange acknowledged this unnecessary asset hoarding and the lack of efficiency from companies. It brought in strict reforms with the idea to “Westernise” the companies, with non-complying companies facing potentially being de-listed or dropped to lower market segments if they did not comply.

The main reforms centred around:

Put simply, all this asset hoarding must stop, margins must be raised (very low vs. US/Europe), excess capital must be paid back to shareholders via dividends and buybacks and the Board needs to prioritise shareholders.

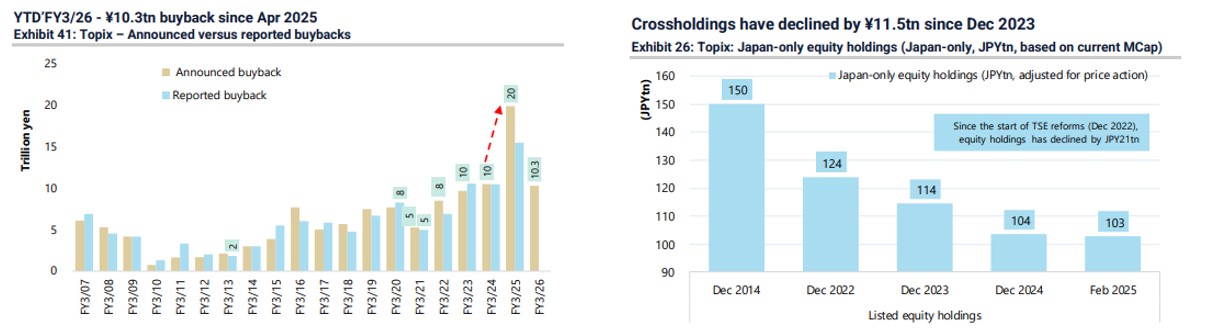

All of these things had not been a priority for the previous 20-30 years and now we have an enormous change. These two graphs show an incredible picture since 2023. TOPIX 100 (100 largest companies) buybacks have gone from 10trn yen (58bn EUR) in 2023 to 10.3 trn yen in first quarter FY26 alone. In other words, buybacks (on an annualised basis) are up 312% in 2 years.

Source: Jefferies [1]

Source: Jefferies [1]

This has primarily been funded by Free Cash Flow, but also the enormous asset sell down of Cross shareholdings (see above). TOPIX 100 had 124 Trillion Yen (713bn EUR) of Cross shareholdings at the start of 2023 which has now declined to 103trn (595bn EUR). This sell down will continue and will be pumped into buybacks.

Did this have any effect?

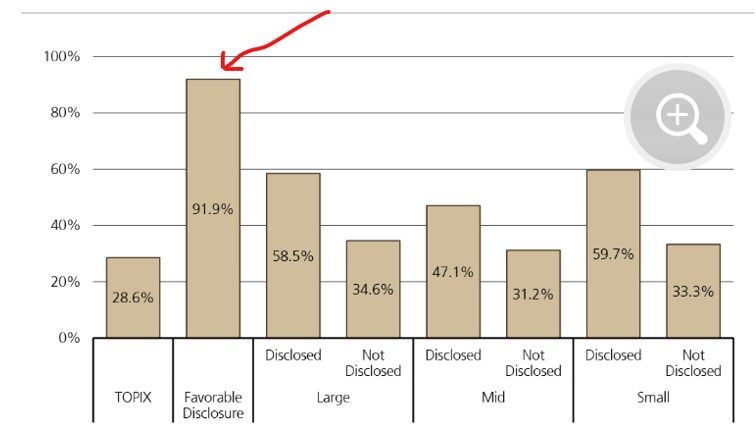

Over the last 2.5 years, companies in the TOPIX 100 (Large companies) which have improved their Disclosure and explained how they will comply are up 91.9% (a 29.5% CAGR)

Source: Jefferies [1]

Source: Jefferies [1]

Where does this leave us today

Now to be clear, this trend is just getting started. Japan is an incredibly Asset Rich and cheap market compared to it’s Western Peers.

It is still very common to see companies trading for the value of their enormous stock portfolio with the “business for free”.

Better yet, there are a lot of companies following a very powerful formula of:

Take Air Water (4088 JP Equity) as an example, a company which we met with the management of. The company is involved within the industrial gases business, which many readers will know (via names like Linde, Air Liquide) etc is an excellent, very high margin and stable/cash generative business.

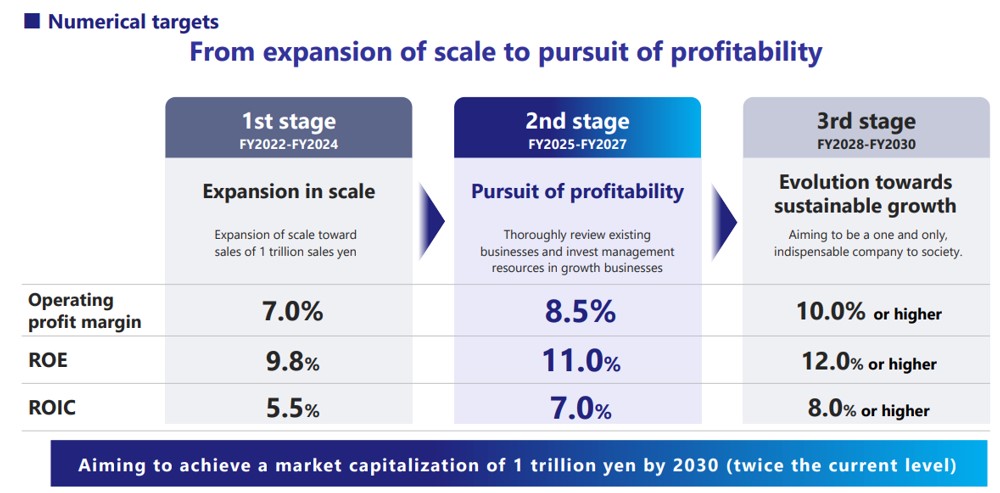

Now having a 1-minute look at Linde, you can see they generate ~30% EBIT margins (best in class). Air Water generates 7%. Further to this, Air Water announced in their FY25 – FY27 Medium Term management plan the intention to divest of low profitability segments, Realise Cash from their Balance sheet and improve operation margins.

Source: FY25 – FY27 Medium Term management plan

Source: FY25 – FY27 Medium Term management plan

Japanese Champions

Now one thing that Japan does have, is incredibly high quality businesses. Anyone who has ever purchased a Nikon Camera or Makita Powertools know’s the quality of the products is excellent.

Hikari Tsushin (9435 JP EQUITY) is a founder led business which follows the Berkshire Hathaway model of having a highly profitable collection of businesses and a large stock portfolio. This well run business has in fact beaten Berkshire’s return over the last 10 years with a 453% return (vs. Berkshires 250%).

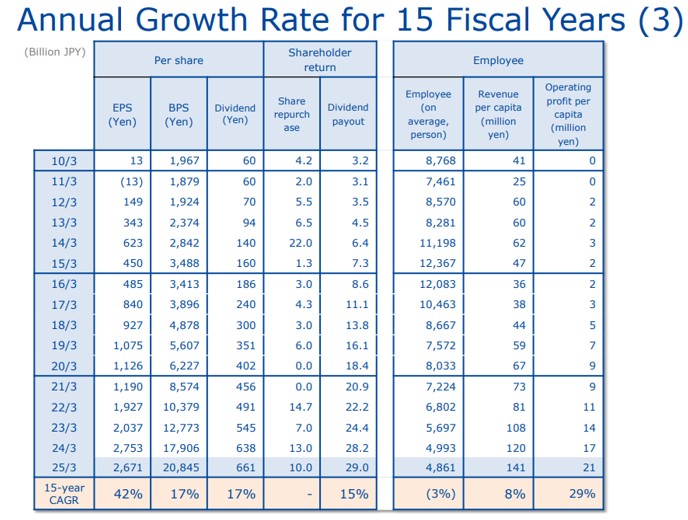

Consulting their presentation , the quality of both the Operating business and the Portfolio are excellent. The Book Value per Share compounded at a CAGR of 17% over the last 15 years and EPS CAGR was 42% over the last 15 years.

Source: HIKARI TSUSHIN Financial Results q2 2025 {2]

Shareholder value in focus

Now for many years, boards were staggered and shareholders were a very low priority in Japan. Shareholders had little ability to enact changes in the company and had to accept the very dull results. With the Tokyo Stock Market reforms, this all changed as Boards welcomed Independent Directors and shareholders were given priority. In the 2025 AGM Season (this year), shareholder proposals have risen 382% alone. With many activists putting forth even more aggressive proposals to boards to sell down excess assets, and use capital towards buybacks and higher dividends.

Source: Jefferies [1]

Summary

The Western World enjoyed an excellent return from the MAG7 and other companies over the last 10 years from strong Free Cash flow growth and aggressive buybacks.

It’s very apparent that Japan is only just beginning this value creation path. In fact, over the last 10 years the median return of the MAG7 was 838%, incredibly impressive.

Looking at the Japanese market, there are already 55 companies [3] which have outperformed this 838% figure over the last 10 years, almost all from improving their Capital Allocation and raising margins from the Stock exchange reforms.

[1] https://content.jefferies.com/secure-link/pdf/02be67d1-a277-404f-8243-c12ad175506c

[2] https://www.hikari.co.jp/en/assets/pdf/ir/39th/1st_presen.pdf

[3] Capital IQ Screening

Blog | 20 jan 2026

Blog | 4 nov 2025

Blog | 17 okt 2025

This website is using cookiesfor statistics and user experience

This website uses cookies to improve your user experience, to provide a basis for improvement and further development of the website and to be able to direct more relevant offers to you.

Feel free to read ours privacy policy. If you agree to our use, choose Accept all. If you want to change your choice afterwards, you will find that option at the bottom of the page.