Henrik Milton

CEO and Portfolio Manager with a focus on tech and software, Brock Milton Capital AB

Please note:

Past performance is not a guarantee of future returns. The value of shares in the fund may go up or down, and an investor may not get back the amount originally invested

Blog & Media

Blog | 28 sep 2025

In September, Herman Ohlsson and I visited San Francisco, San José, and Palo Alto—also known as Silicon Valley. Silicon is an important material used, among other things, to make the essential semiconductors. Nvidia is today the largest company in "the valley," but 30–40 years ago, it was Hewlett-Packard (HP) and Intel that dominated.

During our "Tech Week" trip, arranged by Baird, we met 15 companies, two of which are among the ten largest in the world, Nvidia and Broadcom. In this blog post, we focus on the users of semiconductors—in other words, software companies.

Having met 15 companies that focus on hardware, data centers, and software in one week, I can say that Artificial Intelligence (AI) remains a particularly hot topic, with much emphasis on building and investing in data centers and AI programs. We also met various energy companies, one of which—OKLO—manufactures smaller modular nuclear power plants. I think this speaks volumes about how large the investments into AI are if preparations are in place to build nuclear power plants to supply the data centers with reliable electricity sources.

The companies mentioned in this blog post—Salesforce, Intuit, and Autodesk—develop and use their own AI models. These three software firms also use software from other, better-known AI companies such as OpenAI and Mistral. OpenAI runs the notable ChatGPT AI program, while France's Mistral has its own AI program called Mistral Small 3. During our meetings, both Autodesk and Salesforce explained that they can link their own AI models to programs from OpenAI and Mistral to bolster their own software. The competition is fierce, and it's all about providing users with the best user experience (UX) when using these two companies' products.

Salesforce has become more profitable

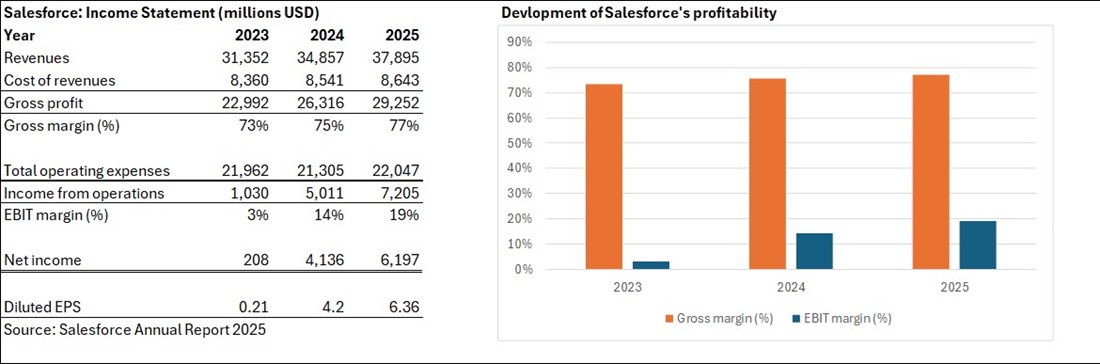

When we met Salesforce two years ago, the IR there laid out the company's plans to invest in profitable sales growth rather than simply focusing on growing revenues. Looking through the company's latest annual report, we see an income statement showing headway in improving the company's profitability.

An extract from the 2025 annual report shows that the company has indeed boosted profitability. In 2023, Salesforce was a typical Californian software firm that focused solely on growing revenues, but today, the company has reached record-high profitability, with a gross margin of 77% and an EBIT margin of 19%. Well done, Salesforce!

Despite the improvement in its profitability, we consider its sales growth relatively mediocre from 2024 to 2025. At the meeting, the IR explained that the rise of "just" some 9% in sales stemmed from a combination of a somewhat worse economic climate and that we are currently in the midst of a technological shift toward AI that affects turnover. The shift toward AI models affects how customers order software from the company.

The IR mentioned a report published by Cambridge, Massachusetts-based MIT, in which the researchers had interviewed 150 managers and 350 employees about 300 different AI projects. The study results showed that 95% of the AI projects had not resulted in any substantial savings or upturn in profitability. Another study by Capgemini in 2023 drew similar conclusions. Source: www.fortune.com. Our opinion about AI models is that they are here to stay, but that the models must be relevant to the job at hand and deliver real efficiency gains for the companies.

Herman Ohlsson and I meet Salesforce in San Francisco September 2025

Like all other software companies, Salesforce is focused on further integrating various AI functions into its CRM system. At the meeting, much was said about Salesforce's AI agents, an AI program that independently performs tasks without human intervention. The agent is controlled via an AI prompt created by a "prompt engineer" (a human) who "says" what job the agent should carry out.

We believe that Salesforce's commercial development, turnover growth, and profitability will stem from how well the company can sell and be paid for its AI services. The company likely expects to increase its prices when AI is further integrated into its products. We will continue to follow Salesforce, and if we believe the company can achieve the same excellent profitability as Microsoft, for example, we might consider it as a holding.

Intuit reminds us of Swedish software company Fortnox

Intuit was another of the fascinating companies we met on our analyst trip to California. What interests us about Intuit is that it reminds us of a Swedish holding, Fortnox, which was acquired and delisted in the early summer. Intuit offers an ecosystem of services for corporates and individuals in areas such as accounting, salary payment, payment solutions, tax payment, credit information, and a marketing platform for email campaigns. It has acquired email and marketing tool Mailchimp, which is probably known to many who work with email campaigns.

During the meeting, Intuit's IR explained how the company wants more from the Mailchimp acquisition and has thus recruited a new manager from Meta (Facebook and Instagram, among other things). Intuit wants to grow further among small and medium-sized companies, and it sees excellent opportunities in this market segment.

With its latest quarterly report in August, the company issued guidance for turnover growth of 12–13% for 2026 and a margin improvement of around 1%. The area expected to show the most growth is Creditkarma, an advisory service for borrowers. Creditkarma is a popular product, with more than 140 million followers on social media. Beyond credit advice, Intuit sees great possibilities to grow in global business solutions and tax payments. Its tax payment service has the fun name of Turbotax, and Intuit expects this to have an especially large total addressable market (TAM). It is always interesting to see companies that have a product with potential for powerful growth.

During the meeting, we heard that Intuit has developed AI services over the past six years for its accounting, payment, financial, and project management products. The purpose of these automated programs that work for themselves is to streamline administrative work. A work task that currently eats up hours of time can, through automation, take only a few minutes to complete. Intuit is not currently a holding in any of our global funds.

Herman Ohlsson and I meet Geoff Koegler, Investor Relation at Intuit.

Herman Ohlsson and I meet Geoff Koegler, Investor Relation at Intuit.

Autodesk is a potential Champion

Autodesk is a firm that sells software for design, construction, and maintenance. Its customers are architects, engineers, design engineers, and designers who use the company's CAD system and simulation programs to design products and systems, among other things. Autodesk's IR kicked off our meeting by explaining that construction is probably one of the least digitalized sectors around the globe. This makes it especially exciting, as it implies considerable growth and earnings potential as the construction sector continues to digitize.

In the past five years, Autodesk has worked hard to develop its various programs, and during the meeting, the IR said that the company was early in combining its software with AI. Its latest move has been the combination of Autodesk's AI model with OpenAI's ChatGPT. Integrating another AI model into its own has rendered the tools more powerful and useful. I asked whether Autodesk was likely to be "disrupted" by a competitor displacing its business model. The IR answered that the reverse was true and that Autodesk is like DeepSeek in that it is itself the disruptor. The IR explained further that its 3D Autodesk AI program is hard to copy and cannot be run in an external AI model.

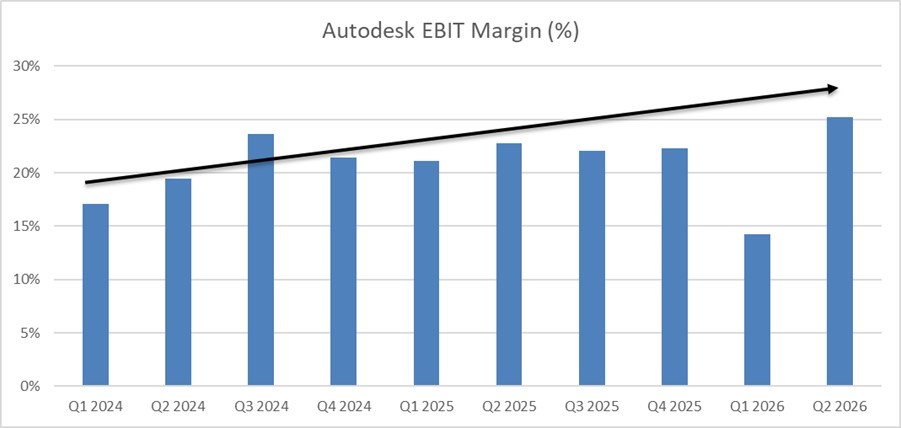

During 2024, Autodesk made a crucial change to its revenue model. Instead of continuing to sell licenses with a one-off payment, the company switched to a subscription model in which customers purchase a monthly or annual license. Moreover, the company has cut out two levels of retailers, with its customers now buying directly on Autodesk's website. Alongside these two major changes to its revenue model, the company communicated an ambitious increase in its EBIT margin target. Through 2029, the margin will increase by a massive 9%. We believe Autodesk possesses the fine features of a Champion and we will keep an eye on this company. Autodesk is not currently a holding in our global funds.

Caption: Autodesk's EBIT margin trends upward. Source: Bloomberg.

Caption: Autodesk's EBIT margin trends upward. Source: Bloomberg.

Share price performance in SEK over the past five years for Intuit (black), MSCI ACWI (red), Autodesk (green), and Salesforce (blue). Source: Bloomberg.

Share price performance in SEK over the past five years for Intuit (black), MSCI ACWI (red), Autodesk (green), and Salesforce (blue). Source: Bloomberg.

Blog | 20 jan 2026

Blog | 4 nov 2025

Blog | 17 okt 2025

This website is using cookiesfor statistics and user experience

This website uses cookies to improve your user experience, to provide a basis for improvement and further development of the website and to be able to direct more relevant offers to you.

Feel free to read ours privacy policy. If you agree to our use, choose Accept all. If you want to change your choice afterwards, you will find that option at the bottom of the page.