The shares that contributed the most in the month were all from the US: Modine Manufacturing, United States Lime & Mineral, and Eagle Materials. Those with the weakest performance were Eurogroup Lamination, Melexis, and Sterling Infrastructure. We note that our exposure to electric vehicle manufacturers performed poorly. We feel comfortable in our long-term exposure to these producers as the shift from fossil fuels to electric vehicles is an essential part of the transition towards a more sustainable world with lower carbon emissions.

During the month, a range of different companies reported, including Modine Manufacturing, Nordnet, and Eagle Materials. Eagle Materials’s revenues increased by 9% y/y, while its profits per share rose by 16%. February will see a majority of the remaining companies in the small cap fund publish their results. An exciting reporting month awaits, in other words.

We have kicked this year off with a number of company visits, including in Italy and India. Read more about this on our blog (in Swedish): https://coeli.se/coelis-forvaltare/global-bloggen/

Key market events and trends (what has influenced performance most?)

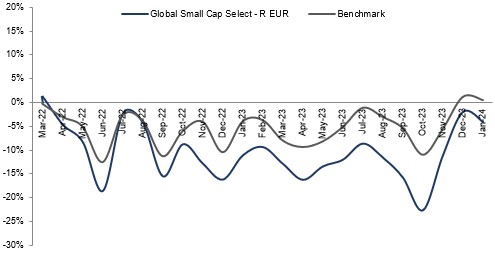

So far in 2024, we have seen market interest rates bouncing back to a somewhat higher level, partly influencing the rise in the small cap stock markets.

So far, last year's trends have continued into 2024, and we see much to suggest that inflation, and thus interest rates, will continue downward, leading to increased consumer strength in the second half of the year. Another compelling observation is that the oil price has been relatively unaffected by the rising geopolitical tensions, something we see as partly stemming from the enormous investments into renewable energy at present. We have no direct investments in the fossil fuel energy sector but do own companies in the renewable energy field.

Looking at the futures market, there is confidence among fixed income managers that the Fed Funds Target Rate will be around 4.0% in January 2025, suggesting that, if the market is correct, there will be six cuts each of 0.25% during 2024.

Portfolio changes

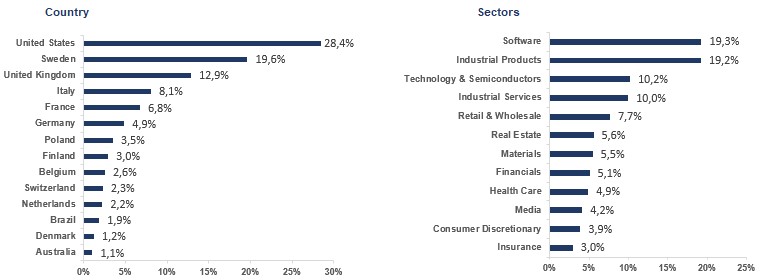

During the month, we added two new US small caps to the fund: Alamo Group and Axcelis Technologies. No companies left the fund, which now comprises a total of 44 holdings. Alamo Group is a manufacturer of machines and equipment for industrial, horticultural, and infrastructure purposes. The other new addition, Axcelis Technologies, is a semiconductor company operating within ion implantation, a key area in semiconductor production.

The fund's positioning—our market expectations

Our small cap fund has a particular skew toward interest rate-sensitive assets, such as real estate, consumer, and installation companies. Several of these will be affected by lower rates, and our belief is that inflation will stabilize at a lower level, prompting central banks to reduce policy rates. Expectations for interest rate cuts should thus propel the stock markets upward in 2024.

We thank you for entrusting your capital to us.