The strongest contributors to the fund's performance in June were Tutor Perini, GXO Logistics, and Cicor Technologies, while the weakest performers were Thryv, Apotea, and Siegfried. Overall, June was a month lacking in much news from our companies. Looking first at those companies that performed the best and then the weakest during the month, it was only the uptick in GXO Logistics and the decline in Apotea's share price that can be explained by company-related news. GXO Logistics, which is the largest pure-play contract logistics provider in the world, lifted its guidance for full-year 2025, both on organic growth and margin development. The market took this news well, as there were concerns that the negative effect of US tariffs on the flow of goods would reduce the volumes that pass through GXO Logistics's facilities. In Apotea's case, a large stock sell-off by several reputable large shareholders, Creades among them, pushed the share price down.

Key market events and trends

Tariff negotiation news in June was overshadowed by the conflict between Iran, Israel, and finally, the US. The impact on the stock market as a whole was limited, however, while the major movements were seen on the commodity markets, with oil prices in particular rising sharply when the attacks began, only to fall back to roughly their previous level once a ceasefire was reached. Looking ahead, we believe the tariff question will again headline the newsflow. This is partly because the tariff pause of 90 days, which was announced soon after the so-called Liberation Day, will soon expire. And partly because we are heading into the first reporting season since the new US tariff policies were implemented. As we wrote in our last newsletter, we believe the stock market can remain sluggish, owing to new tariff plays and as the indirect tariff effects begin to filter through the economic system. We also believe, however, that tariff fears peaked in April.

Portfolio changes

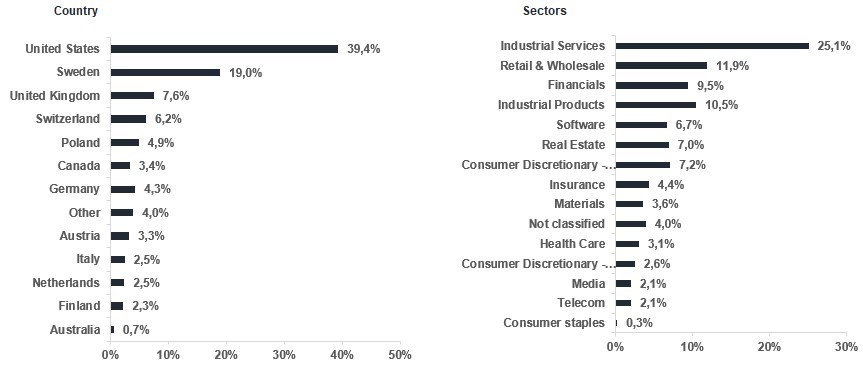

During June, we made one change to the fund, adding Rusta. The company is a leading low-cost chain that operates in Sweden, Norway, Finland, and Germany. After a rough couple of years for consumers in Rusta's key markets, real wage increases and lower interest rates should help bolster sales in existing stores. This, combined with a wave of planned new store openings and a weaker US dollar boosting gross margins, leaves us expecting Rusta to be on the verge of strong profit growth.

The fund's positioning

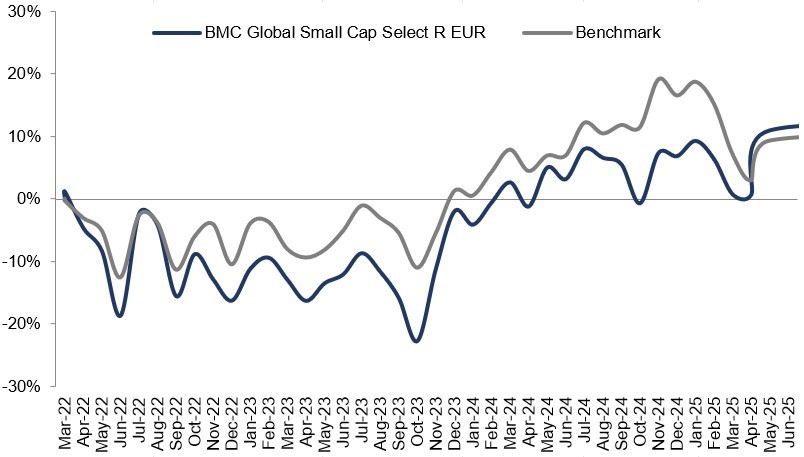

As active investment managers with a global mandate and a concentrated portfolio, we have the advantage of being able to react speedily and reallocate to adapt to new opportunities. In the past year, we have reduced the fund's weighting in US companies and increasingly invested in reasonably value European firms. During the first half of 2025, we quickly reduced our exposure to companies directly affected by tariffs and focused instead on companies positioned well in fields with better future prospects. These include European consumer-oriented companies, which benefit from interest rate cuts and a weaker dollar (much of what is imported is priced in US dollars), and European and US firms within construction and industry, benefiting from large regional investments in infrastructure, defense, and industrial capacity. Accompanied by strong performances by individual companies across a wide range of industries, our fund's aforementioned positioning and the changes we've made have aided the fund's particularly robust relative performance versus its benchmark during H1 2025.

*MSCI ACWI Small Cap NTR $ in EUR