The healthy equity markets seen since the start of the year continued in March, and it is clear many economies have performed well in general. Once the interest rate cuts come, there will be even more momentum. As usual, the markets look to the future, and the expected brightening outlook is already partly priced into stock prices, and we believe the markets are right in their upward movements.

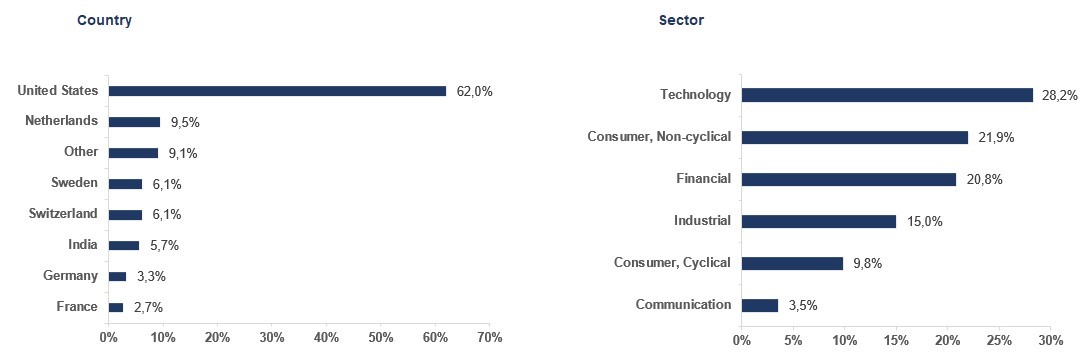

The best contributors to the fund during March were semiconductor producer NVIDIA; air conditioning, heating, and refrigeration equipment distributor Watsco; and auto manufacturer Stellantis. We are especially pleased that the sources of the fund’s returns during the month were from many different industries, demonstrating the power of a diversified global portfolio.

We highlight Stellantis, which has just reported sales in Europe up by 5% during Q1, a figure that suggests European consumers are doing quite well. At the other end of the scale is the mixed bag of Fortnox, Apple, and AMD. Fortnox was the subject of a quite critical Financial Times article that questioned the company’s growth. Around 1% of our fund is invested in Fortnox, and we have neither bought nor sold the stock since the article was published. For now, we watch and evaluate, and will act once we have more information.

Coeli Global has changed name to Brock Milton Capital

We would like to highlight the change in name of our fund management firm to Brock Milton Capital. The name comes from founders Andreas Brock and Henrik Milton, and signals dedicated commitment, recognition, and sustainability. Coeli Global Select is also changing name as part of the move, becoming BMC Global Select as of May 3. As a customer, you do not need to do anything to remain a unitholder; simply keep your fund units in your deposit account and, after May 6, the fund will show up under its new name.

Key market events and trends (what has influenced performance most?)

We believe inflation has settled at a lower level, with the five most recent data points (readings) in the US in the 3.1–3.5% interval. US policy rates are steady at 5.5%, where they have been since August 2023. Among other factors prompting the Fed’s caution in reducing interest rates is that the US job market has proven particularly strong, with low unemployment. In one of his latest speeches, Jerome Powell emphasized the importance of inflation settling at a lower level before the Fed will begin cutting policy rates. This is because the Fed wants to avoid unpleasant surprises for the equity and bond markets should it be forced to change footing and again make hikes after a few rate cuts.

Portfolio changes

After several months of leaving our portfolio largely unchanged, we undertook a raft of changes in March. We sold the real estate companies WDP (Belgium) and Balder (Sweden), along with French bank Société Générale. We have been successful in our investments in both WDP and Balder, while our Société Générale investment never really took off. The bank has still not delivered on its restructuring plan, and while it is possible we might return to it in the future, we take a break for now. Sometimes plans don’t turn out how you’d like. In their stead, we have invested your capital in two US insurance companies, Progressive and Arthur Gallagher. The first holds an especially solid position in vehicle insurance, while the other is one of the US’s leading insurance brokerage firms. Both are well run, with good growth at a reasonable valuation. Two true Champions that we expect to own for the long term.

The fund’s positioning—our market expectations

Our portfolio of the World’s Finest Companies has, in our view, never been stronger. We anticipate profit growth exceeding 18%, high returns on investment, and we note that the companies are stable with very low debt levels—and net cash, in many cases. As always, we acknowledge the changing world we live in, but we feel confident we have a portfolio with excellent odds to create high shareholder value for many years to come.

We thank you for entrusting your capital to us and hope you share our enthusiasm for the new names for our fund management firm and funds. You can always reach us at info@bmcapital.se.

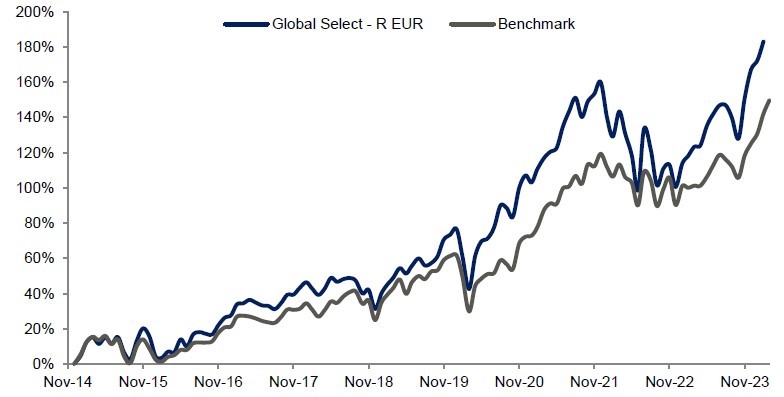

| Performance in Share Class Currency | Mth | YTD | 3 yrs | Since incep |

| Coeli Global Select – R EUR | 2,96% | 9,10% | 34,27% | 191,30% |

| Benchmark | 3,24% | 10,95% | 33,25% | 149,77% |