The shares that contributed the most to returns in May were Tutor Perini, Everus Construction, and IDT, while the weakest contributors were Truecaller, Legacy Housing, and Thryv Holdings. Tutor Perini and Everus Construction both saw relatively weak share price performances at the start of the year. Despite the companies having solid operating developments, with strong outlooks in their full-year reports, the market doubted them and lowered expectations. Given these low market expectations and the subsequent solid reports, in which the order books, revenues, and profits had grown substantially on an annual basis, sentiment regarding the stocks picked up and their share prices traded up by 71% and 43%, repectively, during May. On the other side, there were reports that left their mark on share prices. Truecaller reported what we considered healthy numbers, with the key SaaS revenues growing almost 50% y/y, but reported profits were lower than the market anticipated. The reason for this was fluctuating costs for the incentive program, as well as currency movements, while the company also took some one-off costs for the launch of its new premium offering to iOS users.

Key market events and trends

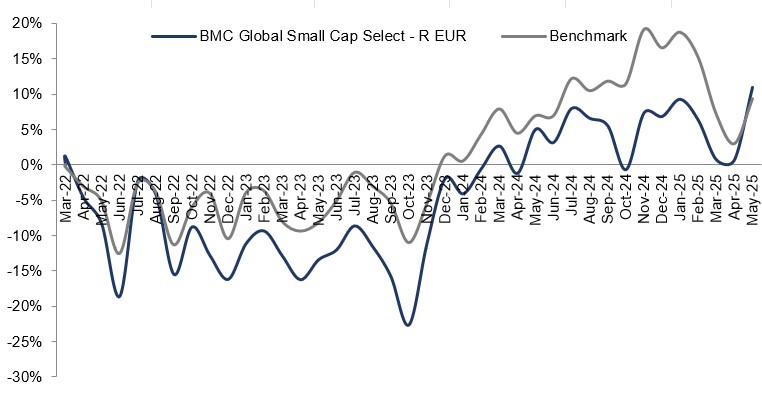

Just like in April, tariff plays and the ongoing reporting season were the focus of the news flow in May. Since April 2—the so-called Liberation Day—uncertainty regarding tariff levels and the consequent effects has been rife, but in May, the market fixed on phrases like "tariff deferral" and "tariff relief," while many companies reported solid Q1 numbers and issued conciliatory messages about the direct effect of tariffs. We expect the stock markets to remain sluggish in the coming month as the indirect effects of tariffs begin to be felt, but we also believe that "tariff alarm" peaked in April. It is clear the US needs to leave this turbulence in the rear-view mirror as speedily as possible to avoid it further damaging its own economy. Our belief is that we will see substantial interest rate cuts in the US as soon as the tariff plays end.

Portfolio changes

Market turbulence continues to create opportunities, and we have identified several great entry points to companies we have followed for a while. During May, we bought into Allegro, NYAB, and Thryv Holdings. Meanwhile, we sold our monitoring position in Instalco after another poor report. Below, we offer short summaries of our new holdings.

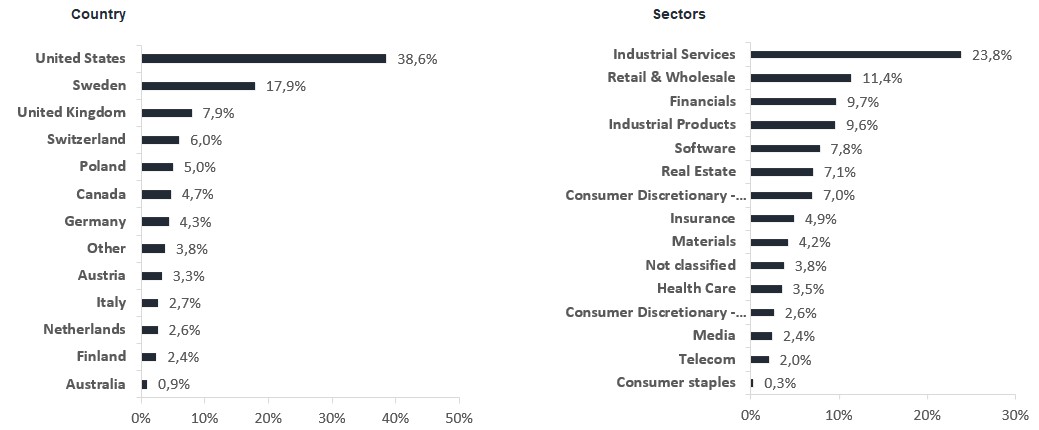

Allegro: The leading e-commerce platform in Poland, with a market share of some 50%, more than 15 milion active customers, and in excess of 160,000 connected merchants. The company expects further double-digit growth, driven by a strong Polish consumer base and even higher online penetration, with further margin improvements thanks to a greater share of associated services (adverts, payments, logistics), economies of scale (scalable cost base), and a turnaround in its loss-making international business.

NYAB: A rapidly growing and particularly profitable engineering firm that project manages complex infratsructure, energy, and industrial projects in northern Sweden and Finland. With the help of its customers' ambitious investment plans, NYAB expects continued organic growth (>30% organic growth in Q1 2025) for many years to come and to use its robust cash flows for complementary acqusitions.

Thryv Holdings: The company runs two separate businesses targeting small US companies: 1) the legacy business, Yellow Pages, which is being phased out; and 2) a SaaS business for invoicing, accounting, payroll, HR, CRM, etc. The SaaS business has seen organic growth of 20–25% a year with rising margins. Its 2030 target is USD 1bn in SaaS revenues and an EBITDA margin of >20%. The business being phased out is expected to generate cash flows of USD >250m in the coming years, which is in line with the group's current net debt.

The fund's positioning—our market expectations

As active portfolio managers with a global mandate and a concentrated portfolio, we have the advantage of being able to act fast to adapt to new situations. We have continued to limit our exposure to companies directly affected by tariffs and increase our exposure to those positioned in industries with better outlooks, such as the European consumer sector. The fund maintains its relative underweight in US stocks, and we are investing in reasonably valued European companies.

*MSCI ACWI Small Cap NTR $ in EUR