The strongest contributors to the fund's development during the month were Alpha Group, United Natural Foods, and Griffon, while the weakest were Truecaller, Catena, and IIFL Finance. July was an intensive reporting month, with many of the fund's holdings revealing their figures for the second quarter. On the whole, our companies continue to perform well, and even though some reports brought a more negative response, this can largely be seen in the light of too high expectations rather than poor numbers. Alpha Group, which was the largest positive contributor during July, did not report but received a takeover bid at a premium of around 25% higher than its share price at the time. A currency broker with a capital-light balance sheet, high double-digit organic growth, and an operating margin in excess of 50%, Alpha Group has been a holding for the fund since April this year. The first indications of a potential takeover bid came in May, and it has since been one of the largest holdings in the fund. We have sold a large share of our Alpha Group holding since the takeover bid was announced in order to add to other holdings.

Truecaller, which was the largest negative contributor to the fund's performance in July, once again reported what we consider solid underlying figures, but the market latched on to strong currency headwinds and costs related to incentive programs distorting comparability for the reported numbers. Underlying, revenues grew by more than 20%, with growth in the key SaaS revenues of almost 50% y/y to now account for about one-third of the total, while the margin, adjusted for items affecting comparability, strengthened further.

Key market events and trends

Once again, the companies and their achievements were at the center of events in July, with less focus on political maneuvers and geopolitical occurrences. Overall, we see most companies coping with the challenges of Q2 well, yet again proving themselves adaptable and flexible in this changing world. Notably, the monumental investments by "big tech" in data centers and AI are only growing in magnitude, with the knock-on effects this has on certain types of construction and industrial companies in the small cap arena. News on the tariffs front has been mostly positive, with an agreement with the US and the EU hopefully including a more stable game plan for companies going forward. Although 15% base tariffs are a definite drawback versus before, the companies now crave stability for their future ventures and investments. And even though some uncertainty regarding new tariff negotiations targeted at individual countries flared up again toward the end of the month, we believe—as we have previously written—that "peak tariff uncertainty" was reached in April.

Portfolio changes

During July, we added two new holdings: IIFL Finance, which is our first Indian holding in the global small cap fund; and United Natural Foods.

IIFL Finance

An owner-operated financial company that has grown to be a leading player in gold loans, microfinancing, and home loans in India. Through rigorous cost control and strict credit granting, the company has grown its book value per share by 15–20% a year since it was founded in the mid-1990s. After regulatory changes temporarily affected parts of the business in recent years, pushing down its valuation below book value, the company is now growing again at its historical average pace.w

United Natural Foods

One of the largest food distributors in the US, which has seen profitability issues spurred by a bad acquisition. A newly recruited management undertook to optimize the distribution network and end unprofitable contracts, prompting a successful turnaround with definitive profitability improvements and solid reductions in the debt ratio. Following temporary setbacks owing to a cyberattack in June, which left the share plummeting more than 30%, we bought into the company. We believe the cyberattack was a dip in the curve and that the company's underlying improvements will be increasingly visible in the coming years.

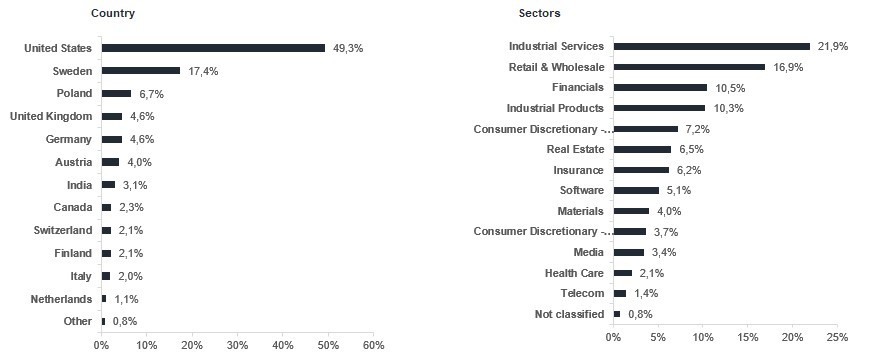

The fund's positioning

As active managers with a global mandate and a concentrated portfolio, we have the advantage of being able to act quickly to allocate investments to adapt to new conditions. During July, we saw many of our US holdings performing well, and given our further investments in existing holdings and a large position in United Natural Foods, the share of the fund now invested in the US is around 50%. Although this is higher than we have had before, it is still an underweight versus our benchmark index. It is important to note that companies are front and center when we invest, and whether we are over- or underweight in a region or an industry is a result of the companies we have chosen to invest in, rather than an active allocation decision. As always, we seek out companies with robust positions in areas with great prospects. One example is European consumer stocks, which benefit from interest rate cuts and a weaker USD (much of what is imported is priced in USD) and European and US construction and industrial companies, which benefit from large regional investments in infrastructure, data centers, defense, and industrial capacity.

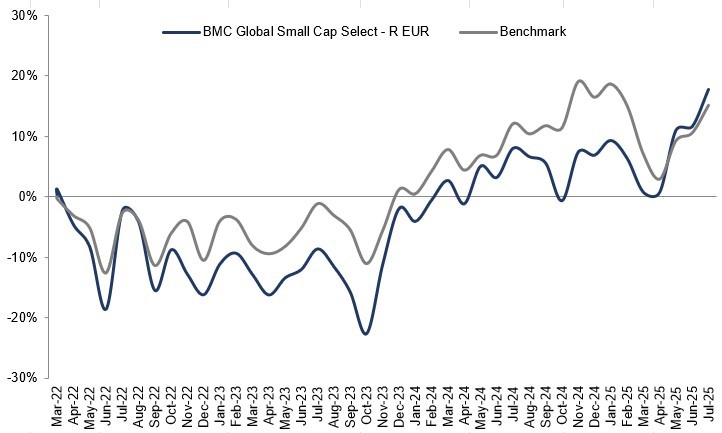

*MSCI ACWI Small Cap NTR $ in EUR