The stocks that offered the best returns during the month were Asbury Automotive, flatexDEGIRO, and REV Group. Those with the weakest performance in January were United States Lime & Mineral, Redox, and Blue Bird Corporation. During the month, Asbury Automotive delivered an incredibly strong report, with both new vehicle sales and the service business showing great progress, and the report came in clearly higher than market expectations. The US's Asbury Automotive is a car dealership business for new and used vehicles. It also sells spare parts and offers servicing alongside financing and insurance.

Key market events and trends (what has influenced performance most?)

The start of the year has been turbulent, to say the least. First, we saw strong gains in stocks exposed to AI and datacenters as Stargate—a joint venture between OpenAI, SoftBank, Oracle and MGX Abu Dhabi—reported a USD 500bn investment in AI infrastructure in the US over the next four years to support the development of next-generation AI models. As a comparison, Microsoft, Meta, Google, and Amazon combined invested around USD 150–200bn in AI and datacenters during 2024. The Stargate news was closely followed by the announcement of DeepSeek, China's latest progress in AI models, prompting hefty stock price drops in these same shares. DeepSeek, China's AI model, has shown a similar capacity to ChatGPT but has been developed at a fraction of the cost. That the model can be trained for one-tenth of current costs of course spreads considerable uncertainty about the future of AI investments if more can be done for less. Whether this is true remains to be seen, but until the data is clarified, we will see ongoing volatility in AI stocks.

Finally, at the end of the month, there was increased unease about whether the Trump administration intended to implement the tariffs it had threatened. So far, this seems to be some type of aggressive negotiation tactic, but the uncertainty means less favorable conditions in which for companies to plan their business, with the risk of a Trump-related discount on the equity markets. And if these tariffs are implemented, they will hit hardest those companies with a large share of their sales in the US for products and services produced beyond US borders. This could, for example, be a US-based industrials company with production located in Mexico and China, or a European consumer company with portion of sales generated by exports to the US.

Portfolio changes

During January we made just one change to BMC Global Small Cap Select, selling off Sweden's Munters. The company has been a great contributor to the fund since the fall of 2022, but expected weakness in its EV batteries business and a change in the product mix for its datacenter business run the risk of putting pressure on margins in 2025.

The fund's positioning—our market expectations

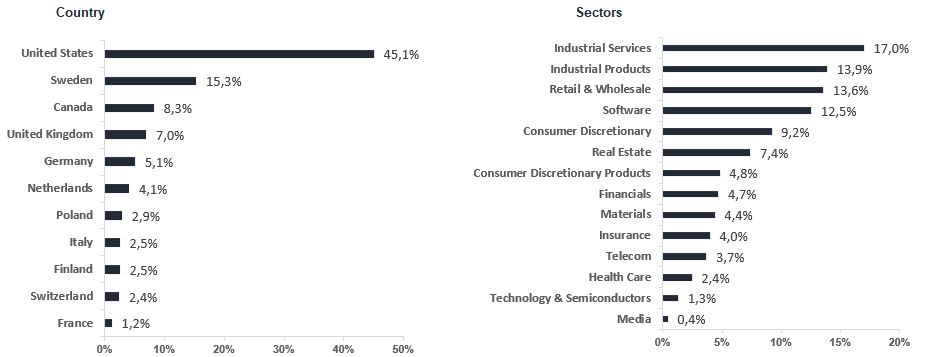

We hold a solid global small cap portfolio with what we see as the world's finest entreprenuer-driven companies—our Champions—in sectors like industrials, retail, software, real estate, building materials, and insurance. We also have a thrilling collection of Special Situations that we invest in at relatively low valuations with the aim of selling at higher levels. With hopes of lower inflation rates, further rate cuts, and a better economic climate, along with appetizing valuations, we see small caps as an asset class positioned for a period of relatively robust returns.

*MSCI ACWI Small Cap NTR USD in EUR