There is one thing more powerful than the President of the US and that is the US fixed income market. When interest rates went up, the president calmed down. He can make himself unpopular with many, but the fixed income market's performance also tamed the actions of the Trump administration. This, combined with the strength of the companies we have invested in, has resulted in the fund's significantly better performance versus its benchmark during April. Among the most potent contributors to the fund this month were 3i, L'Oréal, and Cadence. 3i is performing well ahead of its report, due in a few weeks, while L'Oréal and its 37 global brands reported solid growth of 3.5% for the first quarter of the year, with growth in Asia of 6.9%. This suggests a stabilization in China. This is very much in line with what we have seen on our trips to Asia during the spring. Cadence reported 23% revenue growth and we tip our hat at its ability to grow through thick and thin. On the weaker side, we find Watsco, Kinsale, and Arthur Gallagher, with the first two having reported well for the quarter but slightly below expectations, and the third having seen its share price falter after a stellar performance this year.

Key market events and trends (what has influenced performance most?)

April was a month dominated by tariffs and the ongoing reporting season. Since April 2—the so-called "Liberation Day"—uncertainty regarding tariff levels and their consequences has remained high, but we have also seen many companies indicating a very limited impact so far. There is little hard data pointing to any major slowdown to speak of right now, except in terms of China–US trade itself and the transport sector in the US. Although the situation is volatile, there have been multiple indications in recent weeks of the tone calming down considerably. It is essential there is some form of agreement between China and the US, and we expect the stock exchanges to remain sluggish in the coming month, but also that the winners and losers will become increasingly clear as the new conditions settle in. We continuously work to position the fund to be full of such winners so that our unitholders can benefit from what is happening in the world.

Portfolio changes

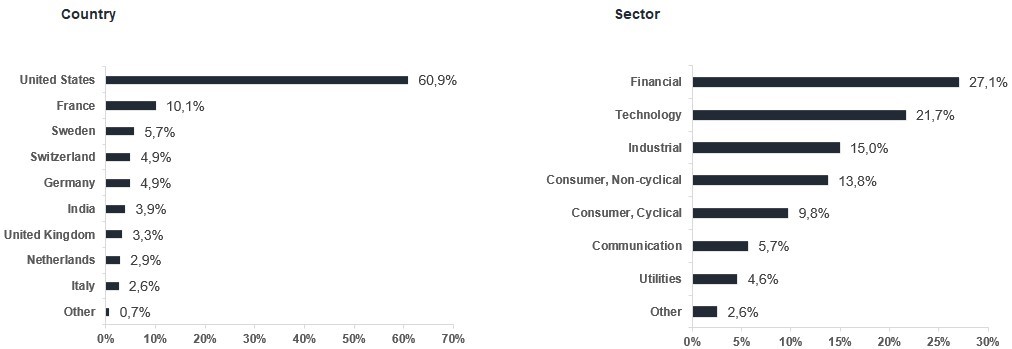

Given all that is going on right now, we see exciting opportunities in financial firms in safe havens like Singapore and Switzerland, and so we have added two new Special Situations to the fund: Singapore Exchange and Swissquote. To finance these additions, we have sold MSCI, Fortnox, and Sika. All are fine companies, but Fortnox had received a bid and we simply believe there is greater upside to be found in those holdings we've bought than in those we've sold.

The fund's positioning—our market expectations

As active investment managers with a global mandate and a concentrate portfolio, we have the advantage of quickly being able to reallocate to adapt to new circumstances. As usual, it is almost impossible to predict global politics, but by positioning ourselves with a portfolio of what we consider some of the World's Finest Companies—with high growth, world-leading brands, and solid balance sheets—we are optimistic for the future.

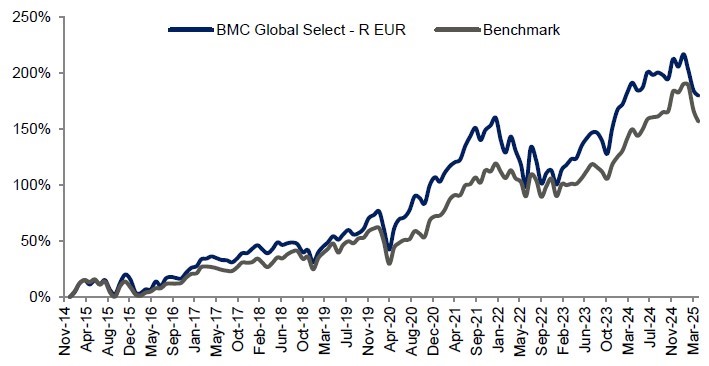

*MSCI All Country World NTR $ in EUR

| 1 Mth | YTD | 5 years | Since incep |

BMC Global Select Fund - R EUR

| -1,77%

| -8,54%

| 73,51%

| 179,66%

|

Benchmark (EUR)

| -3,90%

| -9,24%

| 77,96%

| 156,64%

|