The strongest contributors to the fund's performance in June were ASM, NVIDIA, and Broadcom, driven by greater stock market optimism and declining interest rates in the US, factors that often benefit tech companies in general and semiconductor firms in particular. On the Swedish stock market, investors often express their cyclical view by investing in engineering stocks, while in the US, they turn to semiconductors. Ai investments are not diminishing; if anything, we see them increasing, which should also drive stock prices up in this sector.

The weakest performers in the fund during the month were insurance firms Progressive and Arthur J Gallagher, along with Mastercard. The first two of these had been performing robustly this year, which likely prompted profit-taking, but insurance is also a sector that typically performs a little worse when interest rates drop, such as happened in June. In Mastercard's case, there has been uncertainty that money in its current form will be replaced by Stablecoins, a cryptocurrency linked to the dollar—a fear we believe the market is overreacting to.

Key market events and trends

Tariff negotiation news in June was overshadowed by the conflict between Iran, Israel, and finally, the US. The impact on the stock market as a whole was limited, however, while the major movements were seen on the commodity markets, with oil prices in particular rising sharply when the attacks began, only to fall back to roughly their previous level once a ceasefire was reached. Looking ahead, we believe the tariff question will again be a key aspect of newsflow in July but that the worst on this front is over and that the market will now focus increasingly on the effects of interest rates cuts. These have already been seen in Europe, but will soon be on their way in the US too. The Federal Reserve has increasingly indicated in recent weeks that it will cut interest rates as soon as the tariff uncertainty is resolved and the effect of these has worked its way through the economic system. That rates are likely to come down in the US is positive for stock markets globally. Many of the parameters needed for a strong market this fall are dropping into place.

Portfolio changes

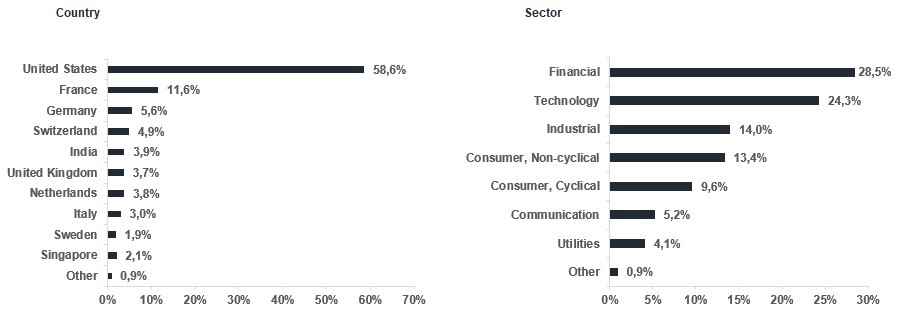

During June, we switched from Apple to Amazon, which has more valued-creating businesses, such as AWS and e-commerce, and will add a satellite network and possibly also robotic vehicles. We believe Apple has lost a little ground with its failed AI venture in Siri and its Apple Car. It has also been a long time since we've seen any new product from the company that has left us astonished. Moreover, we believe Apple's gross margin will weaken in the future as it begins manufacturing smartphones in the US. Amazon simply has better momentum at present, as well as more value drivers and a founder still active in the company—a factor we set much store by. We will continue to keep an eye on Apple and its valuation, but for now, we prefer to invest in Amazon, which we recently held an excellent meeting with when the company visited Stockholm.

We have also invested in the Indian fund management firm HDFC Asset Management, among the largest and one of the leaders in its field in India. We had a great meeting with its own management and that of its parent company, HDFC Bank, which has previously been one of the fund's holdings. India has the world's largest young population, with 65% of people there aged under 35. As their savings begin to increase, HDFC Asset Management should expand its customer base and see greater inflow to its products. Given this and our expectation that the Indian stock market will increase in the coming years, we believe HDFC Asset Management's profits will see a sharp uptick. The company expresses considerable interest in our view of its ESG work, and we have booked a meeting in India with the CEO during the fall to take a more in-depth discussion about the Paris Agreement in particular.

The fund's positioning

We are heading for what we anticipate will be an especially exciting reporting season, when our companies can show what they're capable of. We've made several changes to the portfolio in recent months, shifting more capital into Europe, India, and Singapore, and we now look forward to reaping the rewards of this in the months to come.

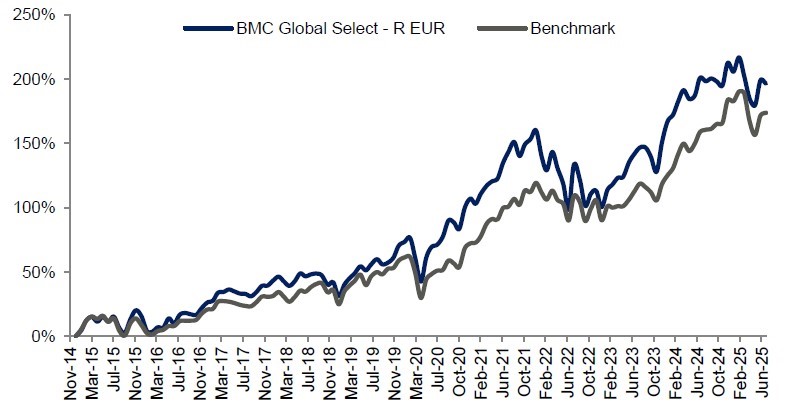

*MSCI All Country World NTR $ in EUR

| 1 mth | YTD | 5 years | Since inception |

| BMC Global Select R EUR | -0,87%

| -3,07%

| 73,00%

| 196,40%

|

| Benchmark EUR | 0,82%

| -3,18%

| 81,22%

| 173,76%

|