The fund saw a solid development during the month and, as we wrote in our previous newsletter, it is clear the AI trend is accelerating once again. During July, we saw further evidence of this, and the strongest contributors to the fund's performance during the month were thus NVIDIA and Cadence, two companies being bolstered by this trend. Our relatively new addition to the fund, Swissquote, also had a good month, and it is now evident that the company has experienced more tailwind during the year than the market had initially forecast. The weakest contributors were ASM, Hermes, and Arthur J Gallagher, largely for company-specific reasons. In ASM's case, it was the geopolitical environment, plus Intel's issues, which led to reduced order intake for the company. Hermes—and also Ferrari—had a weaker month as the company did not expand its volumes much and instead saw prices contributing to growth. The market would prefer to see a combination of these two factors.

Key market events and trends

Once again, the companies and their achievements were at the center of events in July, with less focus on political maneuvers and geopolitical occurrences. Overall, we see most companies coping with the challenges of Q2 well, yet again proving themselves adaptable and flexible in this changing world. Notably, the monumental investments by "big tech" in data centers and AI are only growing in magnitude, with the knock-on effects this has on certain types of construction and industrial companies. News on the tariffs front has been mostly positive, with an agreement with the US and the EU hopefully including a more stable game plan for companies going forward. Although 15% base tariffs are a definite drawback versus before, the companies now crave stability for their future ventures and investments. There is, however, no doubt that Europe is the bigger loser in the trade negotiations and that larger investments in US manufacturing are likely, investments that will benefit our unitholders through the construction companies the fund holds.

Portfolio changes

In our previous newsletter, we wrote that interest rate cuts in the US were drawing near, and this expectation, together with those from the recent reporting season, has prompted us to make changes to the portfolio. During July, we sold Kinsale, an insurance company that will struggle if interest rates in the US go down. Instead, we bought into the US's leading home builder, DR Horton. The company published a superb report during the month, with its share price rising 17% in one day. Although we view most of our holdings as long-term investments, it is also pleasing when a new addition gets off to such a flying start.

We also made changes among our semiconductor holdings, selling ASM to instead buy TSMC, which clearly has more tailwind behind it right now than ASM. We also cut our holding in Atlas Copco ahead of its report, which proved good timing, as the figures were weak and not to the market's liking. Atlas Copco is a quality company, but it is struggling with its organic growth at present. We instead invested this capital in United Natural Foods, a US turnaround Special Situations case. United Natural Foods is one of the largest food distributors in the US, and we've had positive meetings with the company's finance manager, whose solid CV demonstrates experience of one of the most successful turnarounds at General Electric a few years back.

The fund's positioning

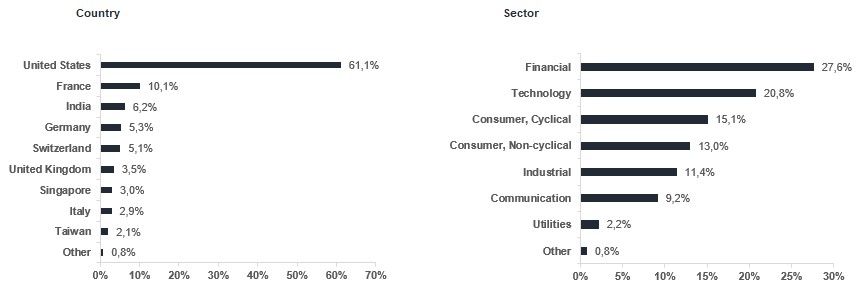

As active managers with a global mandate and a concentrated portfolio, we have the advantage of being able to act quickly to allocate investments to adapt to new conditions. During July, we saw many of our US holdings performing well, which, accompanied by our further investments in new holdings, leaves us confident for the future.

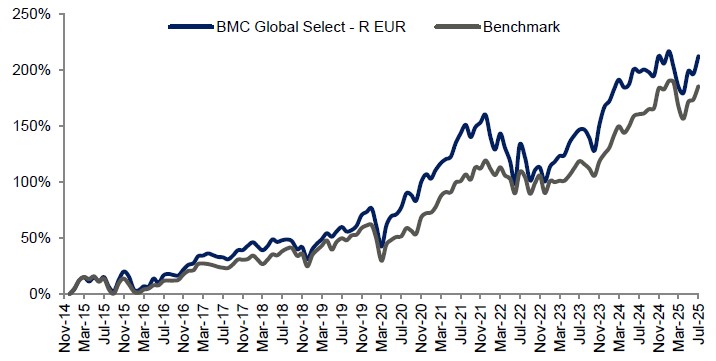

*MSCI All Country World NTR $ in EUR

| 1 mth | YTD | 5 years | Since inception |

BMC Global Select Fund - R EUR

| 5,34%

| 2,11%

| 75,87%

| 212,24%

|

Benchmark (EUR)

| 4,37%

| 1,05%

| 88,40%

| 185,73%

|