The global fund's somewhat weaker performance during the month was largely a consequence of negative contributions from software and industrials companies. The positive contributors were those shares that benefited from lower US interest rates.

Taking a closer look, more specifically at the companies, we see DR Horton, HCA Healthcare, and Alphabet as the largest contributors to the fund in August. DR Horton joined our portfolio in July and so we are especially pleased to see it among the best contributors just the following month.

The weakest contributors to the fund's performance were Watsco, Microsoft, and SAP. The reason for Watsco's poor performance was its quarterly report falling short of market expectations. Company reports were not the reason for the poorer performances of Microsoft and SAP; instead, they were impacted by temporary doubts in the market about software companies' ability to earn money in an increasingly AI-driven world. We believe the market is incorrect in this view, as the more robust software firms like Microsoft and SAP see the best conditions in which to earn money through AI.

During August, we undertook a research trip to Japan, visiting Tokyo, Osaka, and Kyoto. We have visited Japan as a team before, meeting tech companies, while on this trip, we took a broader scope and focused on other exciting firms in various businesses.

During September, our investment management team will visit both New York and San Francisco, meeting software firms and banks on the East Coast. While in San Francisco and Silicon Valley, we will meet a range of exciting tech companies involved with semiconductors and software. Keep an eye on our LinkedIn page and our blog for more on these inspiring trips and company visits.

Key market events and trends

August saw extensive geopolitical uncertainty that dampened risk appetite on the equity markets. Trump has met with Putin, Zelensky, and leaders of the largest European countries without reaching a peace agreement that includes Russian withdrawal from Ukraine. A lasting peace plan would definitely be positive for the equity markets, but right now, a peace agreement looks, unfortunately, some way off.

The sentiment at the Fed's meeting in Jackson Hole was positive, with Fed chair Jerome Powell explaining in his speech that September rate cuts are entirely feasible. The message was welcomed by the equity markets, which jumped for joy at this.

Donald Trump created further uncertainty with speeches on tariffs and support for Ukraine, but the markets are, to some extent, now immune, choosing instead to focus on positive quarterly reports.

Portfolio changes

We made two changes among our Special Situations holdings during the month, selling Nike at a small profit and buying a new real estate company, Millrose Properties, which has gotten off to a good start in the portfolio. We still consider Nike a fine company, but as we saw greater upside potential in the shares of another company, we sold it. Real estate firm Millrose supplies US homebuilder Lennar, among others, with vacant land. What makes Millrose Properties especially exciting is its solid balance sheet and that it trades at a low valuation compared with the average among US real estate stocks.

The fund's positioning

We expect the Fed to cut interest rates in the fall, benefiting all rate-sensitive companies in our portfolio. Our most recent portfolio additions—DR Horton (homebuilder) and Millrose Properties—are excellent examples of companies that will perform well in a lower interest rate environment. Two others that will also benefit from such rate cuts are building materials companies Vulcan Materials and Martin Marietta. The equity markets' decent uptick after the Fed's Jackson Hole meeting in late August offered us a taste of how robust the markets can be in a world of lower interest rates.

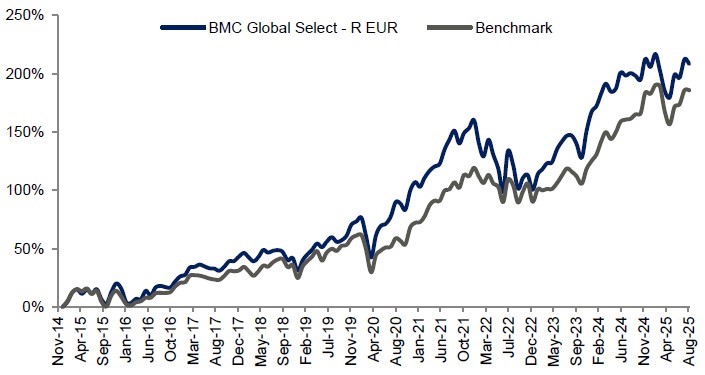

*MSCI All Country World NTR $ in EUR

| 1 mth | YTD | Five years | Since inception |

BMC Global Select Fund - R EUR

| -1,26%

| 0,83%

| 62,31%

| 208,31%

|

Benchmark (EUR)

| 0,03%

| 1,08%

| 79,89%

| 185,81%

|